Canada Post is expanding its financial services offerings with the national launch of the Canada Post MyMoney™ Account, a new spending and savings account designed to improve financial accessibility for Canadians. [Read more…] about Canada Post Launches MyMoney Account Nationwide, Expanding Financial Services for Canadians

Koho

Karla Rent Helps Credit Unions Build Financial Inclusion

Toronto’s Karla Rent is officially emerging from stealth mode with a mission to empower credit unions with cutting-edge financial wellness tools that help them compete with big banks. [Read more…] about Karla Rent Helps Credit Unions Build Financial Inclusion

Fintech Leans Rightward as ‘Build Canada’ Campaign Envisions ‘Bolder, Richer Country’

An army comprised of some of Canada’s biggest names in financial technology has launched a digital campaign encouraging the nation’s entrepreneurs to envision a “bolder, richer, freer country.” [Read more…] about Fintech Leans Rightward as ‘Build Canada’ Campaign Envisions ‘Bolder, Richer Country’

Prevalent ‘Screen Scraping’ in Canadian Fintech a Symptom of Open Banking Void

Half of Canada’s major banking institutions provide features that use “screen scraping,” a widely scrutinized practice, a new report has found. [Read more…] about Prevalent ‘Screen Scraping’ in Canadian Fintech a Symptom of Open Banking Void

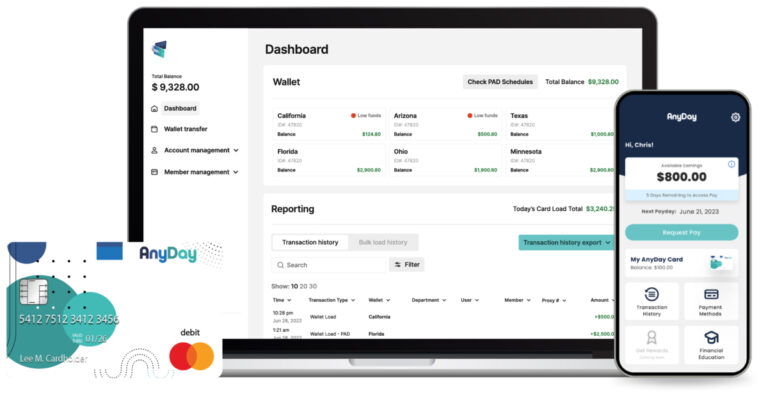

XTM Partners with KOHO to Offer Expanded Financial Services for AnyDay Members

In a move to enhance its offerings, fintech XTM has entered an exclusive referral agreement with KOHO Financial to expand financial services for its over 100,000 AnyDay members. [Read more…] about XTM Partners with KOHO to Offer Expanded Financial Services for AnyDay Members

Neo Financial Leads Deloitte’s Technology Fast 50, Fintechs Dominate List

Deloitte Canada has announced this year’s winners of the Technology Fast 50.

Now in its 27th year, the Technology Fast 50 program recognizes the world-class achievements of Canada’s leading technology companies—highlighting their commitment to innovation, strong leadership, and rapid revenue growth between 2020 and 2023.

This year, the average three-year growth of the Technology Fast 50 winners is 3,559 per cent.

At the top of this year’s Technology Fast 50 list, with a three-year growth of 154,022 per cent, is Neo Financial, leaping from the number one spot in the Companies-to-Watch category last year.

Headquartered in Calgary, the company is building a smarter financial experience for all Canadians using the latest technology. Specializing in savings and credit products, Neo Financial is on a journey to reshape the financial future for millions of people in Canada.

In addition to Neo Financial, ten other fintechs were recognized on this year’s Technology Fast 50 list:

- #5 – Relay, Toronto – 9,578%

- #8 – Aquanow, Vancouver – 3,022%

- #10 – Nesto, Montreal – 2,360%

- #14 – ZayZoon, Calgary – 1,451%

- #25 – KOHO, Vancouver – 880%

- #27 – Conquest Planning, Winnipeg – 858%

- #32 – Irwin, Toronto – 671%

- #35 – Zensurance, Toronto – 595%

- #39 – Plooto, Toronto – 516%

- #41 – Trolley, Montreal – 484%

A Few Fintech Trends in Canada We’re Noticing This Fall

The air is crisp, the leaves are falling, and we suddenly want the hot blazing sun back. It’s autumn in Canada!

This week, Fintech.ca reflects on some of the latest news that’s impacting the trajectory of financial technology across the nation. [Read more…] about A Few Fintech Trends in Canada We’re Noticing This Fall

KOHO Secures $190M to Fuel Growth, Expand Lending, and Advance Bank License Goals

KOHO, a leading Canadian Challenger Bank, announced today that it has secured $190 million in additional funding, consisting of $40 million in equity and $150 million in debt. [Read more…] about KOHO Secures $190M to Fuel Growth, Expand Lending, and Advance Bank License Goals

KOHO Teams Up with Propel Holdings to Offer AI-Powered Lines of Credit

A new partnership between two of Canada’s leading fintechs will bring more credit options to consumers overlooked by traditional financial institutions. [Read more…] about KOHO Teams Up with Propel Holdings to Offer AI-Powered Lines of Credit

KOHO Launches Rent Reporting and Tenant Insurance to Help Canadians Build Credit and Protect Rentals

It is estimated that more than three million people aged 18-plus in Canada are credit invisible.

Being credit invisible means these individuals either do not have a credit file or the credit information on file is insufficient to generate credit scores, which can make life challenging. [Read more…] about KOHO Launches Rent Reporting and Tenant Insurance to Help Canadians Build Credit and Protect Rentals