Open Banking is a globally growing financial services trend that enables financial data to be shared, with the consent of the consumer, with authorized third-party service providers (TPPs). It is intended to be a more secure framework for data sharing through secure channels such as Application Programming Interfaces (APIs), moving away from current data sharing methods such as screen scraping and credential sharing. [Read more…] about Navigating Open Banking: Canada’s Journey Toward Implementation and the Road to a Hybrid Model

Search Results for: open banking

How Much Do Canadians Need to Know About Open Banking, Anyway?

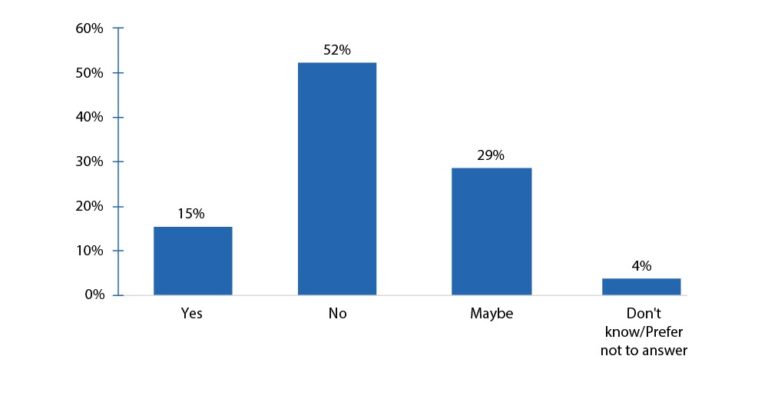

A recent survey by the Financial Consumer Agency of Canada confirmed what we already knew: that Canadians’ awareness and understanding of open banking remains low, despite the Canadian government’s strides toward implementing this financial innovation. [Read more…] about How Much Do Canadians Need to Know About Open Banking, Anyway?

Q+A with Wipro’s Anmol Grover on the Future of Open Banking in Canada

With the rise of open-banking, the role of banks has evolved – from integrators to part of an ecosystem-driven business model. [Read more…] about Q+A with Wipro’s Anmol Grover on the Future of Open Banking in Canada

Canadians Are Still Clueless About Open Banking, Study Finds

Open banking could shape the future of banking in Canada, according to a recent statement from the Financial Consumer Agency of Canada.

But a new study reveals a lack of awareness and understanding of open banking among Canadians. [Read more…] about Canadians Are Still Clueless About Open Banking, Study Finds

Open Banking Expo Canada: Building a ‘Made in Canada’ Framework and Overcoming Roadblocks in the Financial Sector

Open Banking in Canada is underway, with a ‘Made in Canada’ framework starting to take shape. [Read more…] about Open Banking Expo Canada: Building a ‘Made in Canada’ Framework and Overcoming Roadblocks in the Financial Sector

Q+A with Financeit’s Michael Garrity on the Future of Open Banking in Canada

Open banking is a financial services trend that enables third-party providers (TPPs) to access and use financial data from customers with their consent. This is achieved by utilizing application programming interfaces (APIs) that allow secure data exchange between financial institutions and TPPs. [Read more…] about Q+A with Financeit’s Michael Garrity on the Future of Open Banking in Canada

Q+A with Chris Ford, President of Intelliware, on How Fintechs Can Navigate An Open Banking Utility

Open banking – a system that empowers consumers to share their financial data with third-party service providers via their financial institutions – is quickly coming to Canada. [Read more…] about Q+A with Chris Ford, President of Intelliware, on How Fintechs Can Navigate An Open Banking Utility

Symcor Deepens Fintech Footprint with Launch of Open Banking Ecosystem

A Canadian business solutions provider recently announced a new suite of open banking services.

Toronto-based Symcor says its latest launch of open banking services builds on a “proven history of providing utility-based solutions for some of the country’s largest organizations.” [Read more…] about Symcor Deepens Fintech Footprint with Launch of Open Banking Ecosystem

EQ Bank Partners With Flinks To Deliver On Open Banking

EQ Bank, powered by Equitable Bank, has partnered with Flinks to provide EQ Bank customers with the ability to share their financial data securely with third-party fintech applications of their choosing. [Read more…] about EQ Bank Partners With Flinks To Deliver On Open Banking

The Need For Open Banking In Canada: How Fintechs Are Turning The Tide For SMEs

Imagine your small business is fresh off a successful raise of 1.6 million dollars, but when you ask your bank for a corporate credit card, you’re swiftly denied. That’s exactly what happened to Caary co-founders Steve Apostolopoulos and Jason Sawyer, and it’s happening to many of Canada’s small and medium-sized business (SME) owners. [Read more…] about The Need For Open Banking In Canada: How Fintechs Are Turning The Tide For SMEs