In the past decade, we’ve seen Canadians enjoy enormous equity gains in their homes and decade-long sky-high home prices. When we couple this with increased interest rates, the option to upsize or upgrade your home is diminishing for many Canadians. For the time being, renovations of existing home properties are the way to go. [Read more…] about How Canadian Homeowners Can Reinvest In Their Homes Amid Volatile Housing Market

Thought Leaders

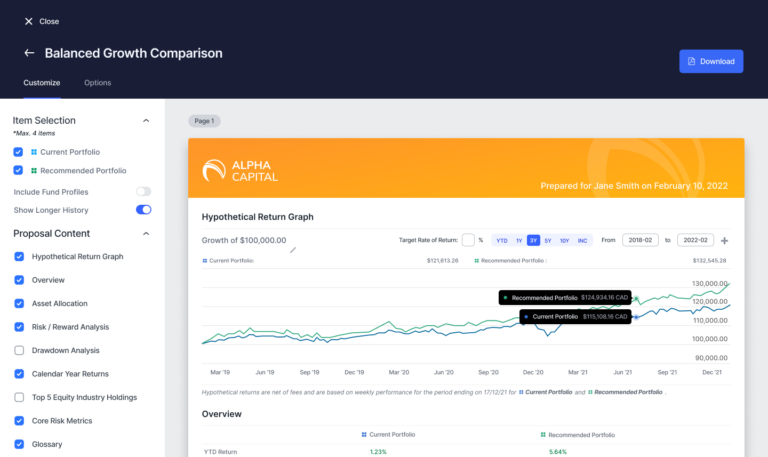

How Financial Professionals Can Use Content Marketing To Stay Competitive

As the advisory business continues to evolve, there is a common theme emerging. Digital adoption is essential to stay relevant and financial professionals that get on board faster will thrive. So how can you differentiate yourself from others and keep up with the pace of Fintech? [Read more…] about How Financial Professionals Can Use Content Marketing To Stay Competitive

The Modern Investor

In March 2020, when the stock market crashed to record lows, Canada saw a significant increase in retail investors. In the first quarter of 2020, more than 500,000 new online brokerage accounts were opened; three times the regular pace in Canada. [Read more…] about The Modern Investor

Why Fintech is the Future of Restaurants: A Case Study

The past two years have been painful times for the hospitality industry, with an estimated 13,000 Canadian food service businesses permanently closing their doors during the pandemic. Many service veterans saw an opportunity to exit the industry to pursue their back-burner dreams, leading to the current labour shortage that’s plaguing hospitality businesses. [Read more…] about Why Fintech is the Future of Restaurants: A Case Study

Interac Research Reveals Canadians are Facing Mounting Fraud Fatigue

Canadians are spending more of their time online than ever before. From using gaming applications, browsing social media, and chatting with friends and family members on multiple platforms, many of our daily activities involve exchanging sensitive information that might be vulnerable to fraudsters. [Read more…] about Interac Research Reveals Canadians are Facing Mounting Fraud Fatigue

Raising Capital as a High-Growth Startup

In a country where innovative startups abound, the availability of capital should never constrain promising businesses with tremendous growth and revenue potential. Unfortunately, the challenges of securing financing have crushed the hopes and dreams of many entrepreneurs, even those with world-changing ideas. [Read more…] about Raising Capital as a High-Growth Startup

How Buy Now, Pay Later Can Reinvigorate B2B Financing in a Post-Pandemic World

Nearly two years since the first nationwide COVID-19 lockdown, the Canadian economy is finally starting to claw its way back to pre-pandemic levels. It’s been a slow and exhaustive process for many, but particularly demoralizing for businesses and the entrepreneurial spirit. [Read more…] about How Buy Now, Pay Later Can Reinvigorate B2B Financing in a Post-Pandemic World

Take Control of Your Crypto: Bitcoin Well CEO Shares Safety Tips

As cryptocurrency continues to gain acceptance in Canada, there has been an influx of consumers looking for ways to participate in this white-hot market. As such, Canadians are being advised to spend wisely and safely as Canadians lost nearly $11 million through digital currency scams alone, second only to wire transfer fraud, in the first eight months of 2020. [Read more…] about Take Control of Your Crypto: Bitcoin Well CEO Shares Safety Tips

Fintech Revolution Will Usher The New Age Of Human Connection

A digital revolution in the wealth management industry has long been talked about, but the pandemic has hastened its arrival. For millions, technology has transformed lives while shifting the global economy to a more enduring transformation than usual. [Read more…] about Fintech Revolution Will Usher The New Age Of Human Connection

Breaking The Cash Logjam In Developing Markets

Building and scaling a FinTech anywhere is a daunting challenge that requires overcoming technology, consumer and regulatory hurdles.

This challenge is even more difficult in developing markets where a large portion of the population lacks access to even a basic bank account that can be used to support a FinTech offering. To get around these constraints you need to adjust your product development approach and be ready to work through challenges you likely never would have predicted. [Read more…] about Breaking The Cash Logjam In Developing Markets