After a record-breaking year in 2021, investment in Canadian fintech dropped by more than 50 per cent in the first six months of 2022, mirroring a broader decline in the technology sector. [Read more…] about Investment in Canadian Fintech Drops To Just Under $1 Billion In First Half Of 2022

Afrifursa Fintech Summit To Bridge Canadian And African Ecosystems

The Afrifursa Fintech Summit is a unique opportunity to connect the Canadian and African fintech ecosystems and engage in social impact partnerships. [Read more…] about Afrifursa Fintech Summit To Bridge Canadian And African Ecosystems

Q+A with QuadFi CEO on How Fintech can Break Down Financial Barriers

Drawn to Canada for its welcoming reputation and innovation in AI, Dr. Manny Nikjoo immigrated in 2006, where he pursued his Master’s degree at Western University, his MBA at York University’s Schulich School of Business, and his Ph.D. at the University of Toronto. [Read more…] about Q+A with QuadFi CEO on How Fintech can Break Down Financial Barriers

Q+A with ShyftLabs’ CEO On Data, E-Commerce and the Canadian Innovation Economy

As we live in an increasingly digitally-integrated world, our user data is more valuable than ever to businesses, informing their business decisions and helping them to better understand their customers. [Read more…] about Q+A with ShyftLabs’ CEO On Data, E-Commerce and the Canadian Innovation Economy

Balance Unveils Tool That Streamlines Regulatory Compliance For FINTRAC Reporting

Toronto digital asset custodian Balance has unveiled Balance Compliance, a turnkey solution which streamlines regulatory compliance for FINTRAC reporting entities dealing in virtual currency such as money services businesses (MSBs). [Read more…] about Balance Unveils Tool That Streamlines Regulatory Compliance For FINTRAC Reporting

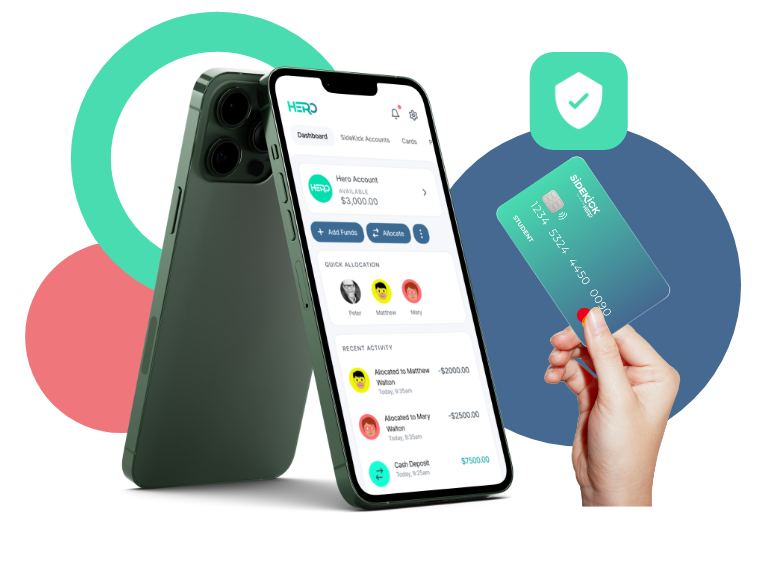

Hero Wants To Help Raise Financially Empowered Kids

Vancouver fintech Hero Innovation Group (CSE: HRO) has launched Hero Financials, a full-service alternative-to-banking solution for Canadian kids, teens, GenZers, and their parents. [Read more…] about Hero Wants To Help Raise Financially Empowered Kids

CIBC Partners With MX To Offer Clients Seamless Access To Third-party Apps

CIBC has entered into a data access agreement with Utah-based B2B data exchange MX. [Read more…] about CIBC Partners With MX To Offer Clients Seamless Access To Third-party Apps

Q+A with Tetra Trust’s CEO Didier Lavallée on being Canada’s First Qualified Custodian for Digital Assets

Didier Lavallée is an accomplished financial services executive with experience in the capital markets and custody sectors with companies such as RBC, UBS and Genuity Capital Markets. [Read more…] about Q+A with Tetra Trust’s CEO Didier Lavallée on being Canada’s First Qualified Custodian for Digital Assets

Calgary’s ZayZoon Secures $25.5 Million To Expand Beyond Wages On-Demand

Calgary fintech ZayZoon has secured $25.5 million in new financing, consisting of $12.5 million in equity and $13 million in a new credit facility with ATB Financial. [Read more…] about Calgary’s ZayZoon Secures $25.5 Million To Expand Beyond Wages On-Demand

Darwynn Secures $20 Million to Launch Nationwide Fulfillment Platform

An Ontario-based company seeking to become one of Canada’s leading and most advanced technology and fulfillment organizations. And it is launching a nationwide platform to do so. [Read more…] about Darwynn Secures $20 Million to Launch Nationwide Fulfillment Platform