Once a startup has blossomed through seed funding, it may seek additional capital to reach the next stage of scale and growth. [Read more…] about 5 Canadian Fintech Startups To Watch In 2023

Nova Scotia Startup Launches to Empower SMBs with Bespoke Bookkeeping Platform

Canadian financial technology entrepreneurs Bill Murphy, Rob Boynes, and Richard Landzaat have cofounded a startup in Halifax. [Read more…] about Nova Scotia Startup Launches to Empower SMBs with Bespoke Bookkeeping Platform

7 Early-Stage Fintech Startups Ready to Blossom in Canada

Seed rounds can prove pivotal milestones for startups. Until that first rush of capital, startups are typically bootstrapped, often operating lean on shoestring budgets with a short runway leading to a steep cliff. [Read more…] about 7 Early-Stage Fintech Startups Ready to Blossom in Canada

Brim’s Fintech Offering Ranked Best-in-Class by Aite-Novarica Group

Financial technology advisory firm Aite-Novarica Group recently ranked Toronto-based Brim Financial’s credit-card-as-a-service as best-in-class for product capabilities in its analysis of the global industry. [Read more…] about Brim’s Fintech Offering Ranked Best-in-Class by Aite-Novarica Group

Techstars Toronto Invests in BC-Based Financial Tech Fledging Ever.ca

Two Vancouver entrepreneurs have launched a financial technology startup.

Ever.ca was cofounded by Jeremy Kuo and Brandon Wang. Kuo has a background in startups and investing, including a recent stint at Stonks, while Wang is a social media influencer with experience at Google, Dell, and more. [Read more…] about Techstars Toronto Invests in BC-Based Financial Tech Fledging Ever.ca

Fintech Predicts ‘CEBA Tsunami’: How to Ride the Looming Loan Refinancing Wave

Amidst a backdrop of inflation and possible recession on the horizon, a coming “CEBA Tsunami” represents a $15 billion opportunity for community lenders to help get capital in the hands of small businesses, according to a study by JUDI.AI and Angus Reid. [Read more…] about Fintech Predicts ‘CEBA Tsunami’: How to Ride the Looming Loan Refinancing Wave

Committed to Credit Inclusion, Propel and Pathward Agree to Five-Year Fintech Partnership

Toronto-based Propel Holdings is committed to credit inclusion by providing fast and transparent access to credit using its proprietary online lending platform. [Read more…] about Committed to Credit Inclusion, Propel and Pathward Agree to Five-Year Fintech Partnership

Toronto Fintech Raises $2 Million to Better Equip Independent Advisors in Canada

Many independent financial advisors seek to digitize operations but lack the technological capability.

This is a problem targeted for solutions by Super Advisor, a Toronto-born startup. The Canadian fintech is building a wealth management platform that returns control to advisors and away from large institutions. [Read more…] about Toronto Fintech Raises $2 Million to Better Equip Independent Advisors in Canada

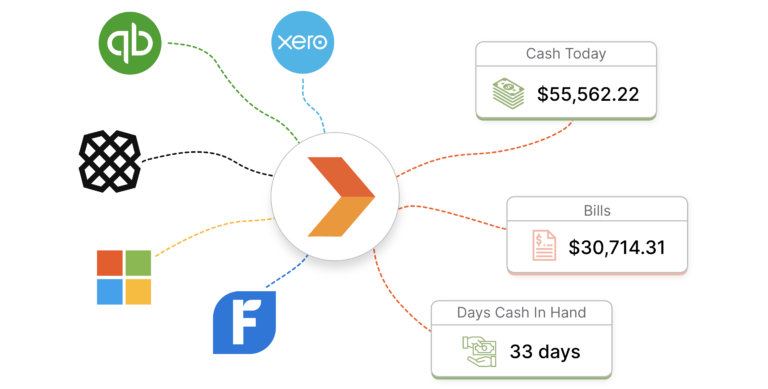

FinTech Automation, ForwardAI Partner to Provide Accounting Data for Financial Institutions

ForwardAI this week announced a partnership with FinTech Automation.

Vancouver-based ForwardAI provides aggregated access to accounting and business data and analysis. FinTech Automation, based in Texas, allows fintechs and traditional financial institutions to offer various embedded finance and banking-as-a-service products. [Read more…] about FinTech Automation, ForwardAI Partner to Provide Accounting Data for Financial Institutions

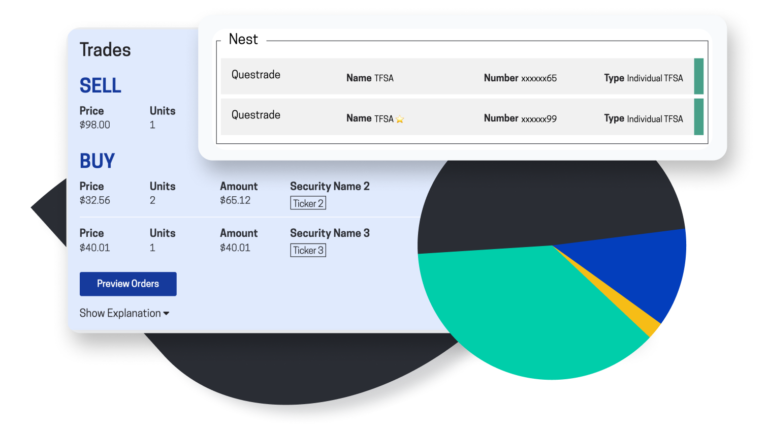

Fredericton Fintech Passiv Raises Seed Capital from Y Combinator and Others

A New Brunswick financial technology startup has raised a seed round.

Following a stint at the iconic Y Combinator accelerator, Fredericton-based fintech Passiv announced this week it has secured a $2.2 million USD seed round. [Read more…] about Fredericton Fintech Passiv Raises Seed Capital from Y Combinator and Others