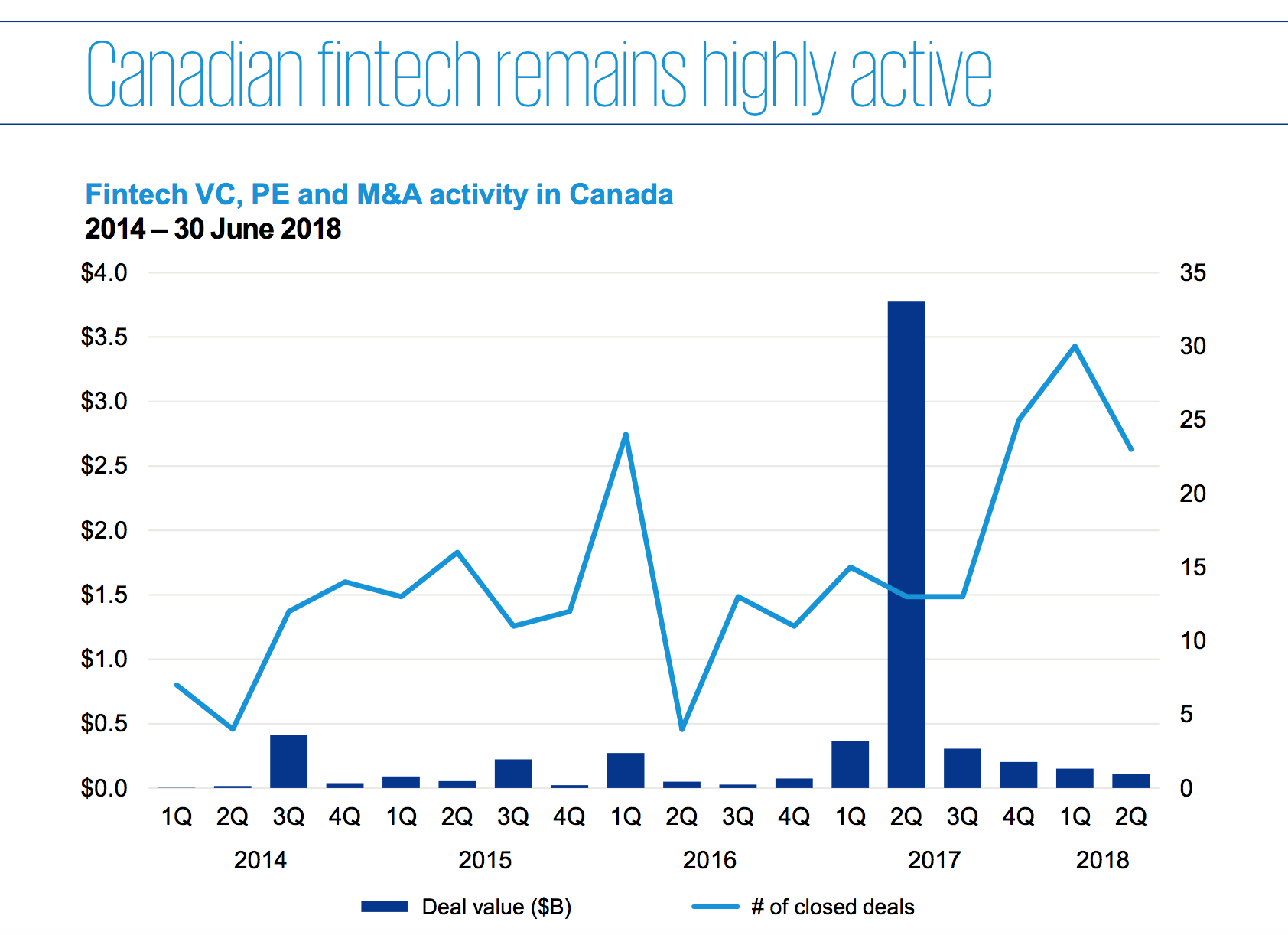

According to KPMG International’s latest Pulse of Fintech report, Canada’s fintech sector has seen an unprecedented volume of deals during the first half of 2018.

“Evolving customer expectations, recent changes stemming from the 2018 federal budget, as well as expected changes coming via the review of the Federal Financial Sector Framework (including the Bank Act), are clearly spurring increased activity in the Canadian fintech sector,” says John Armstrong, National Industry Leader for Financial Services at KPMG in Canada.

“There were more than 50 deals in the first half of 2018 alone. That is almost as many as we saw in all of 2017, the busiest year on record for Canadian fintech.”

“Our country is riding the wave of digital disruption that is changing the financial services ecosystem globally,” adds Armstrong. “Toronto and Montréal, in particular, have emerged as strong fintech hubs and top global destinations for financial and intellectual capital. As financial services regulation in Canada continues to evolve, we are bound to see an even greater increase in activity in the space.”

Canada saw $263 million invested in fintech deals across venture capital (VC) and mergers and acquisitions (M&A) in H1’18. While this number is encouraging, it is off the pace seen in the second half of 2017, when $510 million was invested.

“The spike in the number of deals, however, indicates buyers are focused on getting in early on new technology,” says Armstrong. “Canadian fintech hubs are maturing at a rapid pace and large financial institutions have recognized the need to invest in the space to meet the evolving needs of their customers.”

Leave a Reply