A digital revolution in the wealth management industry has long been talked about, but the pandemic has hastened its arrival. For millions, technology has transformed lives while shifting the global economy to a more enduring transformation than usual.

Of course, some of this intensity may recede in the post-pandemic world, but the deep internalization in the business landscape is striking.

According to the CEO 2021 Outlook, 78 percent of CEOs see an urgent need to shift towards digital opportunities and “divest businesses that face digital obsolescence.”

This technological revolution and the disruptions that have come with it have brought opportunities and challenges. And in the world of financial services, which has historically moved too slowly to reform, dynamism is a necessity. In a similar vein, the pandemic has exposed how unprepared many institutions were for one of the greatest global challenges in generations.

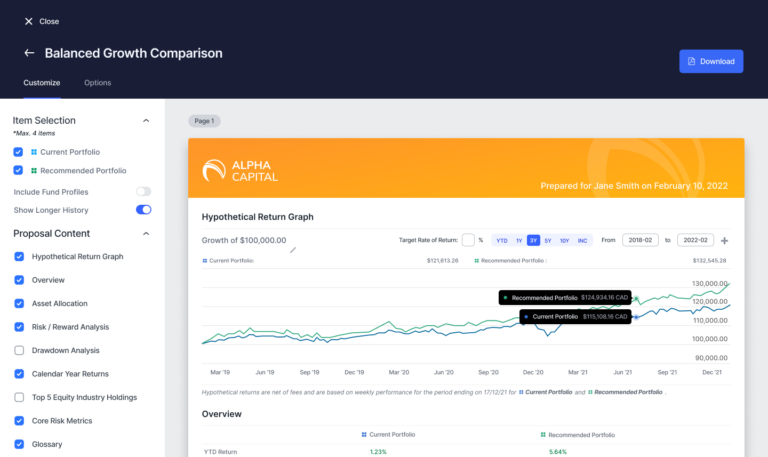

Adaptability is the motto of CapIntel, a B2B fintech company I founded in 2017 that supports financial advisors in their day-to-day workflow, enabling them to spend more time with customers.

I see fintech as an indispensable part of the Fourth Industrial Revolution. Indeed, the ascendance of the digital age has made it possible to create platforms that help break down barriers and build the authentic, long-term relationships vital to any investor’s success.

In essence, our mission at CapIntel is to harness technological potential while enhancing customer relationships and outcomes.

In these rapidly changing times and with the market price action being as fluid as ever, clients are now expecting quick advice delivery to maximize gains. There was a massive influx of new investors in the past two years, with many having very different interests, visions, and values. For advisors to succeed, they need to cultivate deeper personal relationships with those clients while helping them navigate uncertain markets. Financial services companies that remain on traditional systems are at risk of deprioritizing those relationships and will fail to meet client expectations. After all, as the proliferation of digital experience continues, advisors can no longer rely on their exclusive access to markets to attract new clients since today’s consumers have similar access.

Ultimately, digital transformation is a component that will complement the traditional approach to this industry. It will help streamline the archaic systems, maximize efficiency, and reduce wastage of time and resources while laying the groundwork for developing a more organic client-advisor relationship. The wealth-management sector is among the least advanced in adapting to the industry’s new realities. There are some valid reasons for this: risk and costs of adoption, regulation constraints, and of course, widely held belief that clients are resistant to any form of digital change. But for the Canadian wealth-management industry, the winds of change are picking up speed, with increased global competition, volatile markets, and rapid shifting demographics with new priorities.

Surveys show 62 percent of Canadians worry that tech-driven change will lead to a decline in inclusivity, and believe human interaction is an integral part of financial relationships.

As the rapid advances in innovation continue, wealth advisors will increasingly leverage digital tools to deliver investment opportunities. Free from juggling mundane tasks and manual processes, advisors can focus on holistic discussions about the client’s values, dreams, and long-term life goals.

Highly personalized and individually tailored advice will soon be the gold standard in the investing industry. If delivered well, improved relationships and discussions will benefit clients and companies tremendously. Personalization can also come into play during critical situations, with the technology utilized to alert risky decisions by clients who are overreacting to market volatility or more susceptible to FOMO investing.

Amid so much change, financial advisors must understand the world around them and make strategic decisions to guide clients in turbulent times. Building a portfolio is not only about planning but also about human connection, responsiveness, and the ability to quickly and decisively change course.

All this has opened a new path for our future, blending the physical and human needs within this growing digital age. As performance and personalization are now inextricably aligned, it is within our power to strike that delicate balance and fashion a model that builds wealth for all.

James Rockwood is the Founder and CEO of CapIntel.

Leave a Reply