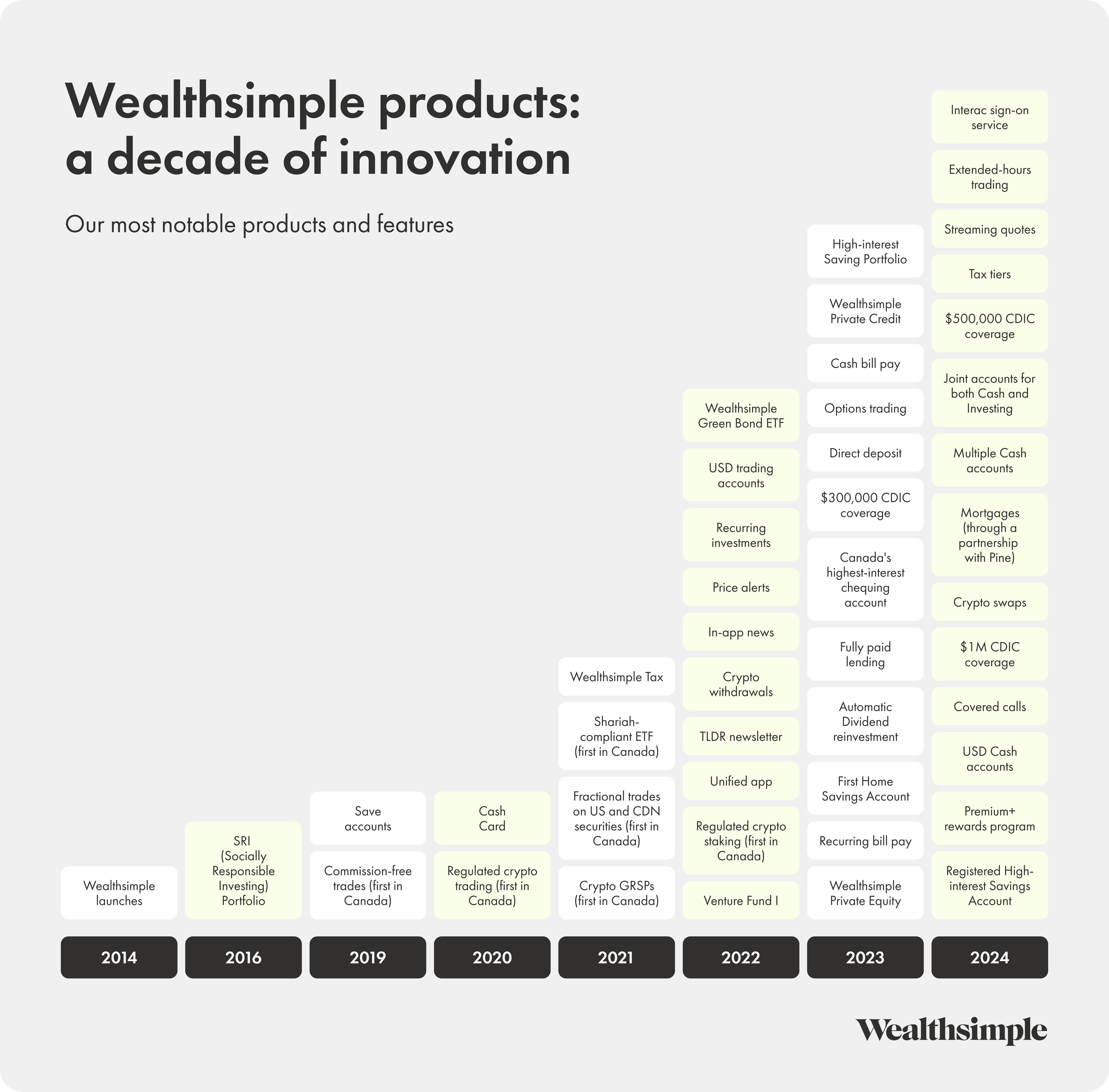

Wealthsimple marked a significant year in 2024, introducing new features and products designed to address Canadians’ evolving financial needs. With a decade of growth, the company has positioned itself as a comprehensive platform offering investment, savings, and spending solutions.

“We’re building something better than a bank,” said Brett Huneycutt, Chief Product Officer at Wealthsimple. “Over the past 10 years, we’ve grown into a sophisticated platform offering a full suite of financial services.”

One of the year’s highlights was the launch of Wealthsimple’s first lending product, margin trading, which has already attracted strong demand. Over one-third of waitlisted clients have begun using the service, reflecting the potential within Canada’s $38 billion margin trading market.

Additionally, the company expanded retail access to alternative investments. Clients with assets of $50,000 or more can now participate in private market opportunities that were previously restricted to wealthier portfolios. The platform’s private funds have already seen $500 million in investments over two years.

Wealthsimple also responded to the continued rally in cryptocurrency markets by introducing ten new currencies and enabling crypto swaps. This change eliminates fiat currency conversions, effectively halving trading fees for users. These moves further solidify the company’s position as a key player in Canada’s cryptocurrency market.

On the savings and spending front, Wealthsimple Cash saw significant updates. The platform added features such as ATM fee reimbursement, paycheque automation, and joint accounts, while expanding its CDIC insurance coverage to $1 million. These enhancements have driven significant growth, with the platform paying over $200 million in interest to clients.

Wealthsimple also became the leading provider of First Home Savings Accounts (FHSA), opening over a third of all such accounts in Canada and helping thousands of Canadians work toward homeownership.

Looking ahead, Wealthsimple plans to expand its offerings in 2025 with margin trading, USD chequing accounts, a credit card, and enhanced advisory services. The company will also continue its mortgage partnership with Pine, which has already helped thousands of Canadians secure homes. These developments underscore Wealthsimple’s commitment to simplifying financial management and expanding access to sophisticated financial tools for all Canadians.

Leave a Reply