Small and medium businesses in Canada are grappling with “significant financial and operational challenges,” finds a recent survey.

The “State of SMB Finance in Canada” survey, conducted at the close of Q3 2024 by Float Financial, found that 87% of Canadian SMBs are confident in their performance—but two-thirds struggle with cash flow and other issues.

“Canadian SMBs are ambitious and optimistic, but they’re being held back by an unmotivated banking sector and outdated financial tools and processes,” believes Rob Khazzam, cofounder and CEO of Float.

These barriers signal an urgent opportunity for innovative financial solutions, posits Float, which offers an integrated suite of products for businesses including corporate cards, bill pay, reimbursements, and other services.

“The current financial ecosystem is stunting the growth of the very businesses that drive our country’s economic engine, and they deserve better,” says Khazzam.

A majority (60%) of SMBs feel more optimistic than in 2023, but concerns such as high operating costs and a lack of access to capital is hindering the growth of many.

Among the concerns, frustration with traditional banks is mounting among SMBs, Float’s data suggests, with a majority of businesses unhappy with interest rates on savings accounts and the benefits of rewards programs, as well as underwhelming customer service. The inefficiencies of traditional banking systems “actively contribute to financial strain for SMBs,” the fintech report concludes.

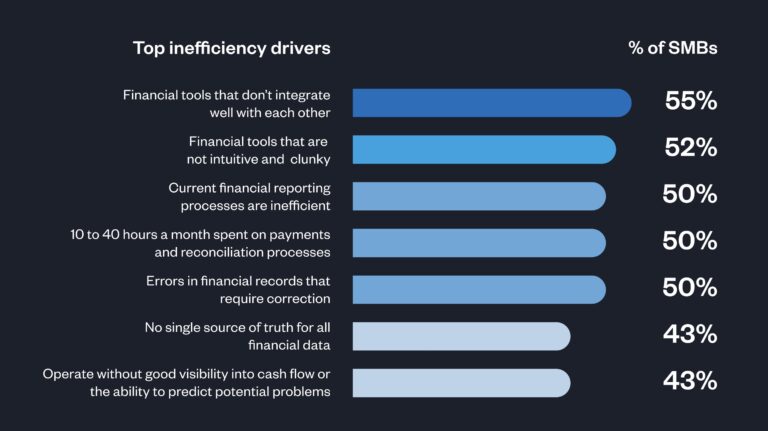

Two-thirds of SMBs report that their team spends too much time on manual data entry while 43% operate without proper visibility into their cash flow or the ability to predict potential problems and make informed decisions around that.

With the value proposition of banks “under intense scrutiny,” Float believes that modern fintech offerings can better suit the dynamic needs of Canadian businesses.

The time is now for financial institutions and fintech companies to reimagine Canada’s financial infrastructure with SMBs in mind, focusing on three critical pillars:

Addressing this problem are Canadian fintechs who can find success with three “critical pillars”: Speed, Access, and Ease. Speed accelerates financial momentum by ensuring money moves as swiftly as business happens, Access unlocks capital, and Ease simplifies management with integrated tools.

“At Float, we recognize that SMBs can’t afford to wait for the financial industry to catch up,” Khazzam said. “That’s why we’re leading the charge in reimagining financial services, and our approach is simple: deliver immediate value through higher returns, flexible funding, and solutions that drive efficiency, while constantly innovating to stay ahead of our customers’ needs.”

Fintechs in Canada possess “the opportunity to not only better serve the SMB market but to also play a pivotal role in driving economic growth and innovation in Canada,” according to Float.

The Toronto fintech raised capital in 2021, then quadrupled revenue in 2023, making it one of Canada’s fastest-growing companies.

Leave a Reply