A Canadian financial technology upstart this week announced an integration with the Fidelity Clearing Canada platform.

Montreal’s Make Fintech says that combining its software-as-a-service platform with FCC’s tech-driven custody and clearing services “creates a powerful, integrated system for advisors to open new accounts, improve client experience, and grow their asset base.”

“We’ve built a powerful, low-code platform that allows us to customize solutions for any client lifecycle situation in the wealth or asset management industry,” says Mako founder Raphael Bouskila.

“We’re extremely proud to be bringing our digital onboarding expertise to Fidelity Clearing Canada clients,” he added.

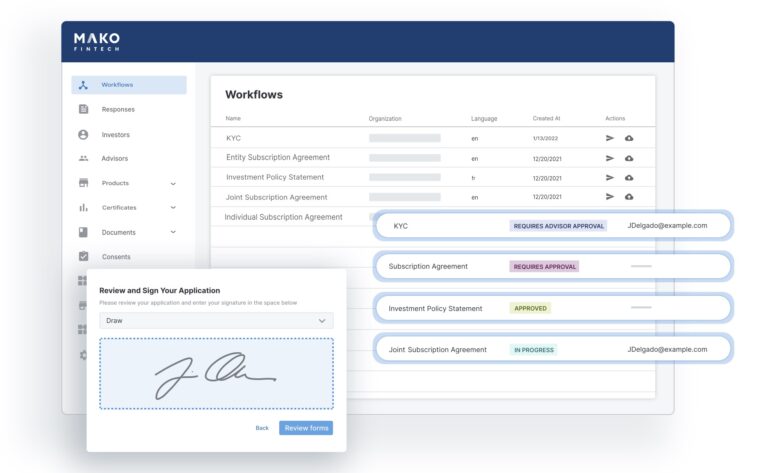

In addition to being low-code, the technology is also agile, Bouskila says, providing wealth advisors with customized workflows, a native e-signature module, and “instantaneous API integrations for custodian account opening, CRM synchronization, ID verification, and AML for faster onboarding and easy information refresh.”

“Our greatest strength is flexibility,” Bouskila believes.

“Leveraging Fidelity’s global expertise and Mako’s innovative low-code platform, we are thrilled to provide optionality to our clients by supporting cutting-edge technology solutions designed to help them scale their businesses efficiently,” stated Joel Bernard, who serves as Head of Sales at Fidelity Clearing Canada.

“This collaboration underscores FCC’s dedication to providing seamless experiences for advisors and portfolio managers and empowering them to drive their own digital journeys,” added Bernard.

Mako was established in Quebec in 2018. Since launch, the fintech’s mission has been to “democratize the digitalization of wealth management and provide operational excellence to our customers through digital transformation.”

Leave a Reply