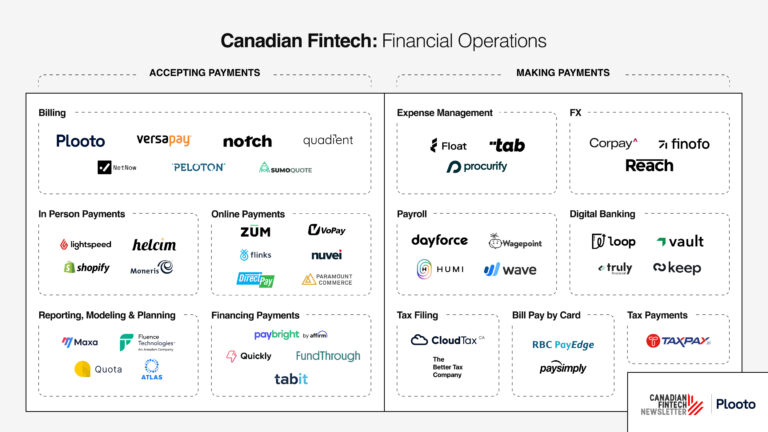

The fintechs in this market map are companies that power the CFO’s office. They allow businesses to issue invoices, process payments, manage expenses & run payroll. These are behind the scenes tools that quite literally allow businesses to send & receive money.

First, let me explain the methodology.

There are two criteria for being included in this map, every company must:

- Be Canadian founded or headquartered

- Service Canadian clients

Second, there is a lot of overlap here. Many of these fintechs could easily go in multiple categories. However each company only appears once.

Third, this map is broadly broken into two categories: accepting payments and making payments. These are often referred to as Accounts Receivable (AR) and Accounts Payable (AP).

Accepting payments

Receiving funds is more than just processing payments. Businesses need tools that manage the entire lifecycle of a transaction. That’s everything from invoicing, to offering various payment methods, to reconciling into an accounting or ERP system, and finally using that data to prepare reports.

Billing

Think of this as the first step in getting paid. It includes preparing quotes, sending out invoices & recurring bills, tracking those receivables & managing collection.

It’s a complex and fraught process. The average Canadian small business waits 27.5 days for invoices to be paid.

Generalists like Plooto improve this by managing the entire workflow of accepting payments, including setting up roles and permissions for the entire finance team. Specialists like Notch & SumoQuote provide these services for niche industries like hospitality or construction.

In Person Payments

The next step is the payment itself. Merchants with physical locations need to be able to process card payments at the point of sale (POS), either through terminals or payment enabled phones.

In the 2000’s Moneris, a joint venture between RBC & BMO dominated the payment terminal market. More recently, modern processors like Lightspeed & Helcim have expanded their digital and in-person terminal footprint, and brought down associated fees.

Online payments

But not all businesses have a storefront. Businesses can increase conversion at online checkout / invoice by offering multiple payment rails. Historically that’s been EFTs & digital cards. Payment gateways like Zum Rails & VoPay, have taken this even further by facilitating Interac e-Transfers (Canada’s debit network) and through bank-to-bank connections (open banking payments) at checkout.

Financing Payments

Funding payments, whether consumer facing or to suppliers is an important lever for finance teams to pull. E-commerce buy-now-pay-later like Paybright, acquired by Affirm in 2020, allows shoppers to break purchases into smaller payments. Similar products from Tabit and Quickly are used to turn vendor payments into installments, either at point of sale or after the fact through invoice factoring.

Reporting, Modeling & Planning

The final step in accepting payments is the data itself. Transactions need to flow directly into accounting systems and ERPs in order to generate reports and analyse the health of your business. Data analytics platforms like Maxa consolidates and analyzes raw business data while tools like Quota use this data for industry benchmarking.

This article originally appeared in the July 15th edition of the Canadian Fintech Newsletter.

Making payments

All of the nuance involved in receiving payments is mirrored in making them. Finance teams need to pay suppliers and employees in different currencies, create spending controls for physical and online expenses, and file and pay taxes seamlessly. All-in-one platforms like Plooto can make these processes simpler by adding automation to payment workflows.

Expense Management

This is the operating system of any finance team. Bill pay requests & approvals need to be monitored and managed to prevent leakage and double payment. Canadian fintechs Float, has become dominant in the Canadian market duplicating the success of similar US based competitors Brex & Ramp.

FX

One of the largest cost centres for businesses is FX. Paying vendors in USD and selling to clients in CAD can lead to 5-7% losses on currency conversion through your bank. The solution is cash management tools that facilitate FX like Corpay for enterprise and Finofo & Reach for SMBs.

Payroll

A business’s largest payments are often to their own staff and require a huge level of compliance and technical oversight. Paying employees and contractors means calculating and withholding contributions to benefits and pension. Fintechs like Wave have built integrations directly into the CRA to make this process completely automated.

Digital Banking

Digital banking is one of the hottest areas of Canadian fintech innovation. Companies like Loop and Vault provide online-first everyday bank accounts to hold deposits, manage treasury, and pay suppliers.

These fintechs are able to exist by partnering with regulated financial institutions like Peoples Group and DC Bank, which allows them to hold client deposits. They differ from traditional banks by providing a completely online experience at a lower price point.

Notably missing here are NorthOne and Relay, both very successful Canadian founded fintechs that only service US businesses.

Tax Filing

The smaller end of small business typically have less complex tax returns creating opportunities for automation through online filing services. These tools replace or supplement the work an accountant would do – compiling financial records and submitting them to the CRA.

Tax Payments

Every business’s favourite part of tax season… is paying them. But despite how straightforward the transaction appears, mistakes are often made. Overpaying, late payments, or payments from the wrong account are commonplace errors. Fintechs like TaxPay automate the process of tax payment either directly or through an accounting firm.

Bill Pay by Card

Not all Canadian businesses accept online payments (see Online Payments above). This means that paying by credit card and collecting the associate rewards, is not always an option. Fintechs like RBC owned PayEdge allow businesses to pay bills by credit card, even when a supplier either doesn’t accept card payments of that amount or full stop.

Tal Schwartz writes the Canadian Fintech Newsletter.

Leave a Reply