If you’re a client of a Canadian financial services company like Borrowell, EQ Bank, Mogo, or Tangerine, you may owe that relationship to Fintel Connect.

In Canada, dozens of financial service brands use Fintel to enhance their marketing through its performance network.

The financial technology firm recently received capital from the federal government to scale operations and expand its workforce.

The $1.5 million in funding, supplied through PacifiCan’s Business Scale-Up and Productivity program, comes at a time when the Vancouver-based upstart is seeking to expand and growth in the US.

“We’re investing in the success of . . . innovative Vancouver companies so they can scale up and go global,” stated Mary Ng, Minister of Export Promotion, International Trade, and Economic Development. “This world-class city is home to some of our best and brightest who are pushing the boundaries in so many different exciting sectors and we’re going to bring this talent around the world.”

Founded in 2019, Fintel Connect launched in 2020 and was named to Rocket Builders’ 2021 “Ready to Rocket” list before raising a seed round in 2022.

The startup was conceived by longtime entrepreneur Nicky Senyard (she founded Income Access in 2002), who remains at the helm of her company.

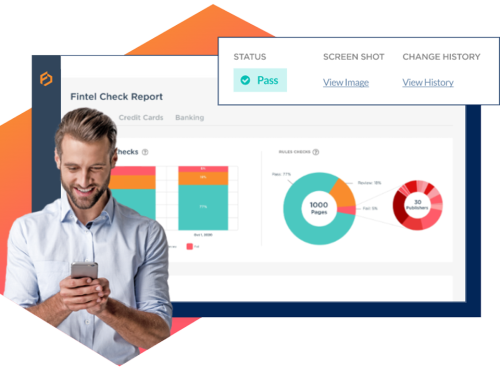

“Our performance marketing platform empowers financial institutions to reach their business goals by leveraging our extensive network and advanced tracking and analytics capabilities,” the chief executive officer stated last year, which helps banks and others “optimize their marketing strategies and achieve sustainable growth.”

Leave a Reply