Canadian investors are mostly satisfied with their financial advisor, a recent survey found, but there remains room for improvement in key areas.

While a majority of Canadian investors informed Angus Reid (on behalf of Toronto fintech CapIntel) that they are content with their advisor, respondents were quick to offer suggestions regarding potential service upgrades.

When asked what improvements they would like to see, Canadian investors issued demands for more personalized advice, increased transparency around fees, and enhanced financial literacy education.

“It’s never been more clear how important the client experience is for advisors,” says James Rockwood, founder of CapIntel.

The 2024 CapIntel Investor Engagement Report, which polled over 1,000 Canadian investors who work with a financial advisor, found that as digital aspects take over the financial realm, a human element remains a critical ingredient for client engagement.

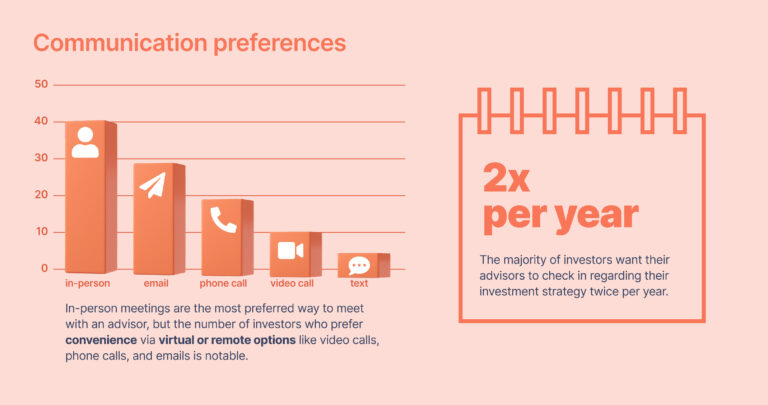

While digital communication has its role, in-person meetings are the preferred method of communication for nearly half of investors (41 per cent). This reinforced by the fact that relationships are at the centre of the human experience—when asked to rank why they continue to work with their current advisor, the top response cited was a “trusted relationship built over time.”

Fesh and blood still matter, but the report also affirmed how technology has changed the level of financial service which a client hopes to experience as well as unlocked new ways to receive said service.

As advisors aim to “impress clients in an evolving digital environment,” Rockwood believes that modern fintech can “help streamline their processes and deliver investment advice that reflects a deep understanding of their client’s unique financial objectives.”

Technology can also help advisors improve their everyday offerings by tracking and tailoring client interactions at scale. From software that helps advisors bring advice to life with graphs and context to keeping client history and communication securely recorded in one place for compliance and marketing purposes, numerous tools can enhance the client experience.

To successfully embrace the fintech evolution, advisors need solutions that improve the client experience and scale, the report concludes. Adopting tools that automate mundane everyday tasks “will unlock valuable client-facing time that’s necessary in today’s relationship-driven business.”

“As advisors navigate the client landscape of 2024, they should prioritize building strong client relationships rooted in trust and implement technology to help provide the level of service today’s investors demand,” the report reads. “If they do not, advisors will fail to connect with their clients and prospects and risk offering an unsatisfactory service.”

CapIntel has partnered with CIBC as well as with Manitoba fintech Conquest Planning, and even SEI, a global provider of technology and investment solutions for the financial services industry.

12,000 advisors across North America use CapIntel’s platform.

Leave a Reply