A property technology firm based in Toronto today announced the closing of $26 million in equity and debt financing.

On a mission to make homeownership more accessible, Requity Homes secured capital from Highline Beta, Boardwalk Investment, Conconi Growth Partners, the Archangel Adrenaline Fund, and an array of angel investors—including financial services executive Mike Dobbins, who joins Requity’s board of directors.

“We’re excited to continue supporting Requity Homes and its social mission to make homeownership more accessible for an underserved customer segment,” stated Ben Yoskovitz, founding partner at Highline Beta.

Millions of Canadians who pay rent and have cash flow struggle to qualify for a mortgage, according to Requity Homes, which has developed a rent-to-own program that breaks down barriers to homeownership.

“Every part of the program, from credit coaching to rent reporting, is focused on getting clients ready for homeownership as soon as possible,” says Sam Sun, an angel investor in the round. “Requity Homes is helping to tackle the homeownership gap by putting financial education front-and-centre in its clients’ experience.”

The startup is tackling what is perhaps the nation’s most pressing issue: One’s ability to afford their own home in Canada.

“Now more than ever, Canada is in need of affordable homes,” observes Sam Kolias, chief executive of Boardwalk.

“With the increasing challenges in the housing market, alternative paths to homeownership are essential,” agrees Amy Ding, chief executive of Requity.

Requity Homes makes homeownership attainable by “leveraging investors who provide upfront capital to support Canadians looking to take their first steps towards owning a home,” explains Kolias, adding that “The team has remained singularly focused on creating a homeownership program that is fair and flexible.”

“We’re proud to share that 80% of our customers have successfully bought back their homes in 18 months on average,” stated Ding. “This is a strong testament to our commitment to providing innovative and practical financing solutions for many newcomers, self-employed workers, and business owners in need.”

Ding says the financing enables her company to continue its mission of empowering more Canadians to realize the dream of homeownership, ensuring stability and financial growth for families across the country.

Requity was founded in Toronto in 2020 and raised seed capital in 2022.

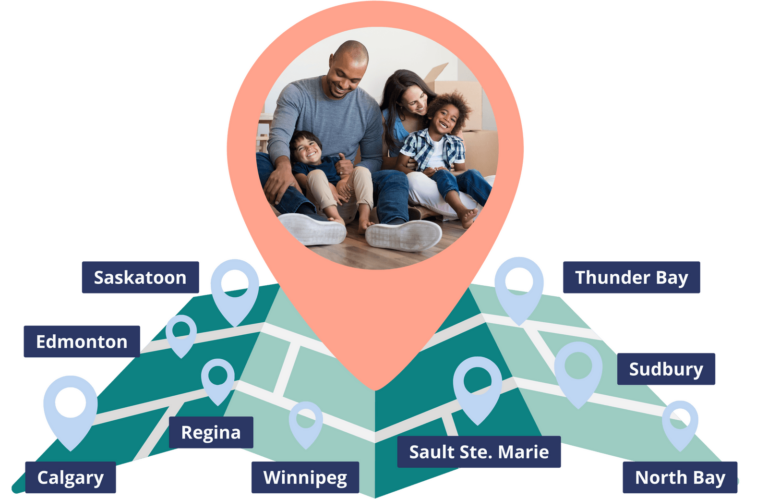

The proptech’s program is currently available throughout Northern Ontario, Saskatchewan, Alberta, and Manitoba.

Leave a Reply