A nonprofit operating at the intersection of real estate, technology, and entrepreneurship in Canada this week released its third annual report on the state of prop-tech across the nation.

Proptech Collective’s 2023 report reveals an array of insights into Canada’s prop-tech landscape, from where and how ecosystems are flourishing to who’s raising the most capital.

There are now more than 500 prop-tech firms founded in Canada, according to the Collective report, with more than three-quarters of those companies concentrated within five major hubs: Toronto, Vancouver, Montreal, Calgary, and the Kitchener-Waterloo corridor.

As the technological disruption of real estate has emerged recently but rapidly, it’s no surprise that prop-techs are more likely to be startups than incumbents, with 75% of firms founded within the last decade, and more than 30 established within the last year.

The need for prop-tech startups is perhaps higher than ever, argues Stephanie Wood, who headed the report for Proptech Collective.

“As the global real estate market is faced with challenges related to both interest rates and sustainability, innovation is critical to pave a positive and stable path forward,” stated Wood, who also serves as Vice President of Alate Partners, a Toronto-based investor in Canadian prop-techs. “Proptech founders, VC investors, and real estate leaders must lean on technology to become more efficient and build more resilience.”

Frank Magliocco, Real Estate Leader for PWC Canada, agrees, stating that tech-forward solutions is necessary given current economic conditions.

“At a time of industry headwinds ranging from interest rates and financing issues to rising construction costs and productivity challenges, the need to adopt digital solutions that increase efficiencies and grow revenues has become even more pressing,” he said.

But can a digital transformation of Canada’s real estate industry be achieved?

Wood believes that “Canada has the talent and means to do so,” with evidence backing up her statement found in the Collective report.

“Reflecting on the last three editions, it’s clear that the sector has experienced a surge of interest and we’re proud of the market’s growth, which has continued to position Canada as a hub for real estate innovation,” she explains. “This year’s report is a celebratory look back on the growth and achievements of the sector, but also a critical look forward at what’s needed to be as competitive as possible.”

Prop-tech ecosystem support appears robust, with several Canadian accelerators targeting innovation in the sector, including Creative Destruction Labs, Highline Beta, Communitech Hyperdrive, and Harvest Builders.

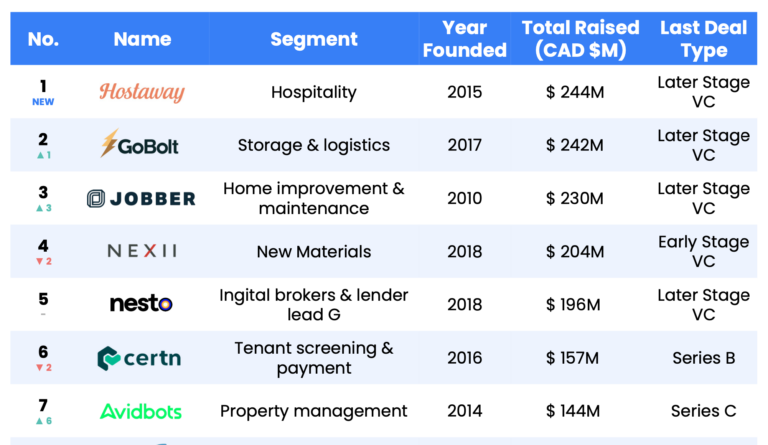

Startups in prop-tech are also often well-funded; below are the top-funded prop-tech firms in Canada.

- Hostaway, founded in 2015, has secured a total of $244 million in funding, bringing it to first place.

- GoBolt, in a close second, has raised $242M since 2017.

- Founded in 2010, Jobber has raised $230M.

- Nexii has secured more than $200M since 2018.

- Established in 2018, Nesto has raised $196M in venture capital.

Certn, Avidbots, dcbel, Carbon Cure, and BrainBox AI round out the top 10, according to the Collective report.

Check out our coverage of last year’s report here.

Leave a Reply