From nearly 150 applicants and twenty five selected companies, the second annual Digital Commerce Bank Calgary Fintech Awards are nearing the homestretch with just 12 finalists now competing for the crown title.

With a focus on everything from revolutionizing the housing and renovation industry to streamlining credit applications and optimizing the capital raising process, these finalists are redefining the financial landscape in Calgary and beyond. This year, the award’s horizons expanded to include startups from all corners of Canada.

Here are the Top 12 fintechs competing for over $300,000 in non-dilutive cash:

Bidmii is a renovation marketplace that guarantees payment security for each party by holding payments in trust, eliminating stolen deposits for homeowners and reducing contractor accounts receivable by 98%.

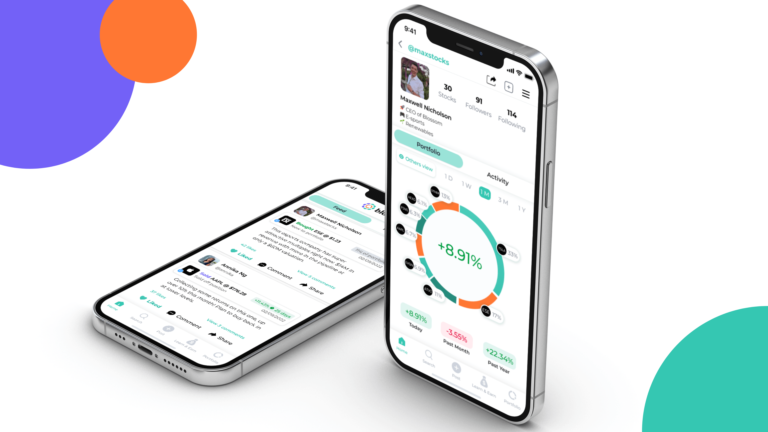

Blossom Social is an app striving to create an inclusive space for sharing portfolios, trades, and investment insights. It has a community of over 30,000 Canadians.

Credit App has a goal is to redefine the connection between automotive dealerships and lenders, bringing innovation through their credit application platform to an industry calling for change.

DealPoint emerges as a beacon for those navigating the complex world of raising private capital. DealPoint’s platform digitizes investor onboarding and investment execution, bringing efficiency to the complicated, paper-based fundraising process.

Elev strives to simplify off-campus living experiences for students. Elev serves both students and landlords, seeking to create a more inclusive housing market.

Expedier is Canada’s first Black-led BIPOC focused digital bank and has the potential to shape the future of global finance by helping underbanked immigrants struggling with foreign banking systems by enhancing financial access.

LenderBidding is the country’s only mortgage auction platform, leveraging competition to guarantee optimal rates for borrowers.

Padder champions a change in the rental market, aiming to help landlords manage and grow their real estate portfolios while their tenants build their credit.

Periculum is an African-focused artificial intelligence and machine learning company that builds data analytic software solutions to help African organizations make better decisions. The company is solving access to credit for immigrants and newcomers to Canada by augmenting banks’ current credit assessment processes with their AI and ML data analytic software.

Propra is navigating the realm of autonomous property management. The potential to focus on growth while technology handles administrative tasks is at the core of Propra’s vision.

Quickly Technologies is an “Earned Revenue Access” technology that lets small and medium businesses take control of their working capital by solving credit terms and getting them paid for their verified invoices.

Yield Exchange is revolutionizing the GIC marketplace by providing transparency and access to competitive rates. With over 20 Canadian financial institutions on the platform, Yield Exchange has facilitated over $250 million in posted GIC requests.

Leave a Reply