As financial transactions increasingly shift online and social media is the widespread norm, Canadians are being introduced to a dynamic way to manage their money.

Mosea, a Toronto-based fintech startup, is helping reshape Canada’s payments landscape by offering a versatile platform for instant money transfers.

Since its inception in 2019, the fintech has evolved from a simple tool designed to help university students split bills to a comprehensive financial management app for large groups of friends.

Mosea now brings a communal vibe to financial transactions by merging social interaction with personal finance.

Digital payment apps like Venmo, CashApp, and Zelle have been popular through the US and Europe but Canada has remained reliant on email-based money-transferring. With the introduction of Mosea, Canadians are getting a taste of a modern, chic payments app that mirrors the convenience seen in global counterparts, according to cofounder Aidan Tighe.

“Mosea is revolutionizing the Canadian payments space by bringing it up to speed with the American payments market,” the startup’s CMO wrote online. “The app is free to use and offers fast, secure and reliable transactions, making it a great alternative to traditional banking methods.”

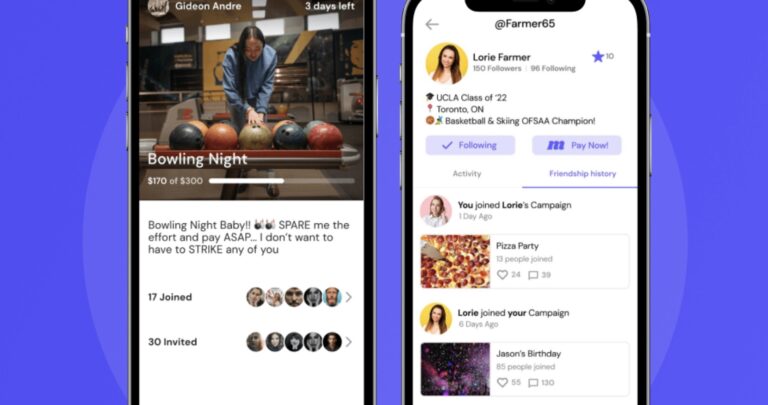

Mosea stands out in the crowded fintech space with a host of innovative features tailored to the users’ evolving needs. At the forefront is a bill-splitting feature, which allows up to 20 friends to split bills evenly or by specific amounts. This feature has proven a godsend for large groups who dine out together or embark on shared adventures. Mosea helps everyone maintain a clear record of who owes what.

Another feature of Mosea is the ongoing ledger of previous transactions. Nestled in your Mosea Wallet, this record-keeping function enables users to monitor their transaction history and address outstanding payments. Forgetting about past transactions or money owed by friends becomes a thing of the past, Tighe says.

Adding more social elements to finance, Mosea enables users to personalize their profiles with a picture, bio, and friend list. As users follow friends, their activity appears on a personalized newsfeed, creating a social media-esque ecosystem around money management. The Explore Page offers the opportunity to search for friends and find suggested people to follow, fostering a greater sense of community.

And of course, security is a paramount concern at Mosea. In partnership with VISA Canada and the Royal Bank of Canada, the app ensures credit card and other bank information is securely handled by Stripe and Plaid.

With its blend of social interaction and financial management, Mosea is emerging as a “Venmo for Canada.” Offering a fun way to navigate financial interactions, the Toronto fintech could become the app of choice for Canadians seeking an intuitive way to handle money.

I use this app. Downloaded it back in March and have used it on several occasions to collect money from my buddies. This is a Canadian hidden gem. Process is super simple. Can’t believe it isn’t more mainstream.