Although awareness of tech-forward banking remains low in Canada, recent research conducted by the Canadian Prepaid Providers Organization suggests a consumer shift among younger Canadians toward digital payments and banking, exposing a growing digital divide across demographic lines.

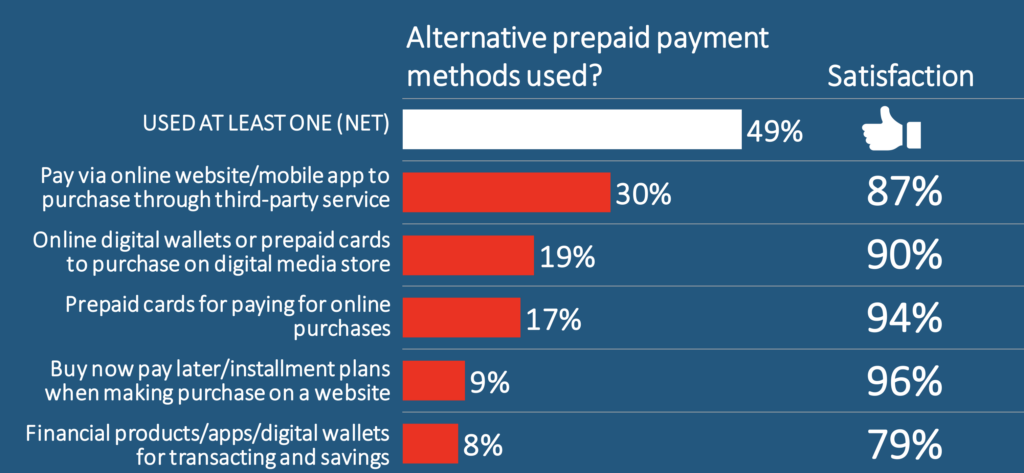

The study examined the usage and satisfaction levels of traditional payment methods—such as credit, debit, prepaid, and cash—compared to emerging digital solutions like mobile payments and digital wallets.

It found that those under 55 are transitioning toward non-traditional, digital financial services at a faster rate than older Canadians.

“We are pleased to see the shift in consumer satisfaction toward a wide array of digital financial services and tools,” Jennifer Tramontana, Executive Director of the CPPO, stated.

This shift in consumer behaviour manifests a preference for a multi-banked approach, where Canadians use various payment and transaction methods for different aspects of their lives while also seeking non-traditional financial services that offer more mobile payment options.

“Prepaid is a driver of this trend, providing a secure, nimble platform to build and innovate financial services upon,” Tramontana says.

Canadians aged 54 and under use credit and cash less frequently, opting for digital wallets, prepaid options, and other digital payment methods, according to the report. In digital alternatives, Canadians prize choice, security, and value.

The prepaid industry is a $9 billion market in Canada, with an extensive value chain that includes networks, regulated banks and financial institutions, challenger banks and program managers. As prepaid issuers invest in prepaid solutions, they are supporting the government in delivering stimulus payments with more efficiency.

As part of the modern payments technology platform in Canada, prepaid solutions have proven their value by displacing cheques, leading to economic benefits for governments and businesses, and serving as a foundation for digital financial services that allow fintechs and traditional institutions to push the boundaries of what a “card” can do.

“Prepaid is really providing both those incumbent banking organizations, as well as those new fintech entrants, a way to introduce new products and services—while still adhering to our stringent regulatory requirements here in Canada,” noted Tramontana.

Open-loop prepaid products, which are tied to a payment network and provide a secure and flexible online payment option, are increasingly being used as a platform to boost financial health.

This is particularly true for gig workers who are seeking quick access to pay through digital apps to improve their financial well-being, CPPO’s report points out.

Leave a Reply