A Quebec-based startup that provides insurance professionals with a conversational assistant powered by artificial intelligence announced this month the closing of an early-stage financing round.

Koïos Intelligence secured $6.5 million through in a round involving Propulia Capital, Canada Economic Development, Export Development Canada, Caisse Desjardins des Technologies, and other private investors.

The Montreal fintech and its investors are convinced that natural language processing is poised to revolutionize the operations of organizations, according to statement from the startup.

“We are pleased to support and welcome a visionary company like Koïos into our ecosystem of start-ups, offering an innovative solution that improves the experience of all parties involved in the entire value chain,” stated Geneviève Biron, Founder of Propulia Capital, who became an advisor to Koïos’s Board of Directors.

Mohamed Hanini, chief executive of Koïos Intelligence, says the funding will empower his startup to expand into new markets and advance the technology behind its virtual assistant.

“Our growth has been significant since the company’s launch and this round of financing will allow us to further solidify our business strategy,” Hanini said. “In the medium term, our goal is to become the first conversational assistant in the insurance industry in Canada and the United States, revolutionizing the way people shop for insurance coverage.”

In 2022, the majority of insurance sales were still done over the phone or in-person and required an average of over an hour. However, according to a survey conducted by Koïos Intelligence, consumers expect much shorter wait times for insurance and often prefer digital shopping experiences.

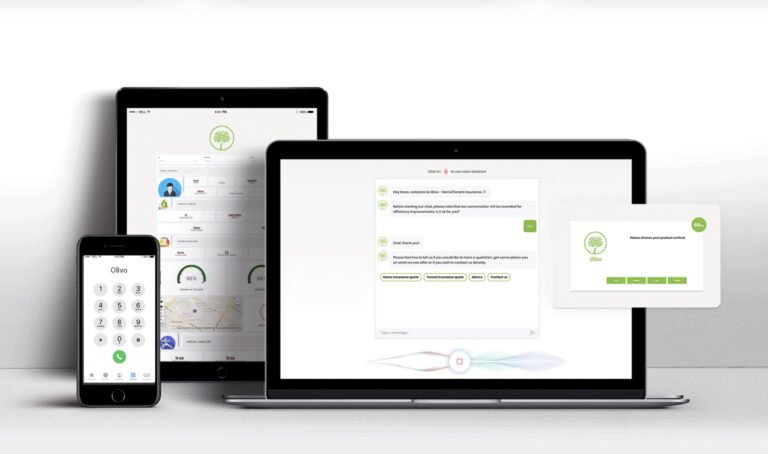

Koïos’ Olivo conversational assistant is AI-powered and acts as a virtual intermediary between the insurance broker and the consumer, allowing the consumer to shop for different coverage options, and even complete insurance purchases. Olivo is interconnected with insurance industry systems such as Applied and the Centre for Study of Insurance Operations, which allow Koïos Intelligence to be part of the insurance value chain.

This connectivity streamlines the pre-purchase, purchase, and post-purchase processes for all types of insurance products through data automation, according to the company.

The standardization of processes allows for greater efficiency throughout the value chain, Koïos says, including a 30% reduction in administrative costs for insurance agent and “a potential 400% increase in sale conversion rates.”

“In the near future, the nature of the activities of insurance agents and brokers will evolve towards more personalized advice, along with a drastic reduction in data entry, since virtual assistants can do this job very well,” said Hanini.

“We are pleased to support and welcome a visionary company like Koïos into our ecosystem of start-ups, offering an innovative solution that improves the experience of all parties involved in the entire value chain,” says Geneviève Biron, Founder and Managing Director of Propulia Capital, who became a close advisor to Koïos’s Board of Directors.

Koïos was founded in Montreal in 2017 to empower the financial industry with AI—a popular thread woven among many modern Canadian fintechs.

Leave a Reply