It seems that the Government is going green with envy over Bitcoin.

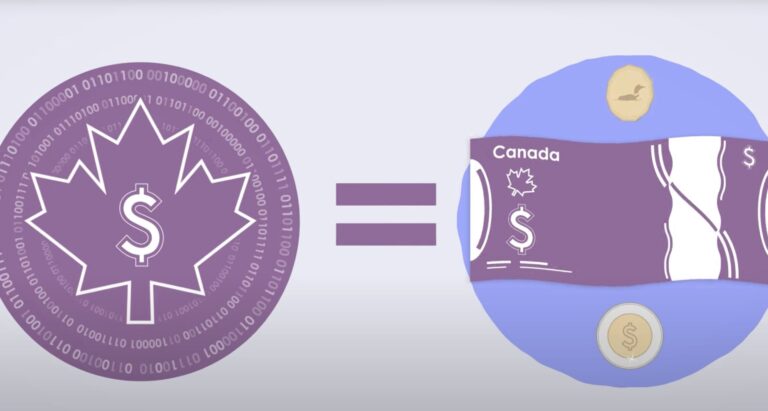

As Bitcoin and cryptocurrencies gain popularity in Canada and beyond, the Bank of Canada has announced a public consultation on a digital Canadian dollar.

The Bank is seeking opinions on how people would use a digital dollar, what security features are important, and which concerns about accessibility and privacy people have.

“As the world becomes increasingly digital, the Bank—like many other central banks—is exploring a digital version of Canada’s national currency,” a statement from the Crown corporation reads.

One could argue resources would be better spent on boosting Bitcoin adoption in Canada, for example, rather than adding another layer to our centralized and regional currency.

But according to Senior Deputy Governor Carolyn Rogers, a digital Canadian dollar would be designed to serve Canadians’ needs.

“As Canada’s central bank, we want to make sure everyone can always take part in our country’s economy,” Rogers stated. “That means being ready for whatever the future holds.”

The Bank insists “cash isn’t going anywhere.” A digital Canadian dollar would not replace cash, the Crown corp says: “We will continue to supply bank notes as long as Canadians want to use them.”

“However, people tend to use cash less often these days: most payments are already digital, such as using debit or credit cards,” the Bank notes. “If this trend continues, there may come a time when cash is not widely accepted in day-to-day transactions, which could exclude many Canadians from the economy.”

The consultation, which opened this week, runs until June 19. Canadians can take a survey to inform the Bank how they feel about various aspects of a digital dollar.

“We want to hear from Canadians about what they value most in the design of a digital dollar,” Rogers said. “This will help us make design choices and ensure that it is secure, reliable and meets the needs of Canadians.”

A report summarizing the findings will be published later this year.

Leave a Reply