For immigrants to Canada, establishing a strong financial foundation can be a challenge. The system may not recognize their credit history, leaving them “invisible” to financial institutions upon arrival.

Immigrants can get stuck in a “fundamentally flawed system that bars them from accessing affordable credit needed to build their new life,” according to an Albertan fintech.

Woveo, a startup based in Calgary, believes that community savings and lending practices are the keys to breaking the cycle of underrepresentation of new immigrants in the Canadian financial system.

The startup’s fresh approach to credit access enables new Canadians to establish a strong financial foundation, empowering them to build a better life.

“At Woveo, we believe that community savings and lending practices are the keys to breaking the cycle of underrepresentation of new immigrants in the Canadian financial system,” states the company online. “Their repayment history of saving and lending can and should be counted towards building a credit profile and unlocking financial opportunities for newcomers to Canada.”

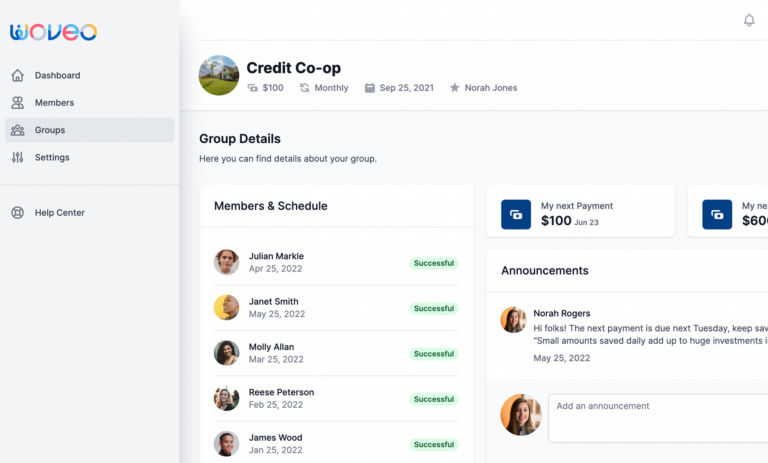

Woveo has created a community wallet that empowers members to build credit history using a rotating savings model connected to people they know and trust.

It’s an on-ramp to establishing strong financial roots in Canada, earning newcomers recognition for positive actions they’re taking to build a life. Woveo communities no longer bear the weight of group coordination and payment accountability on their own.

“Lending Circles are groups of people who pool funds together to access interest-free loans,” the startup explains. Loan amounts range from $300 to $5,000, with each group member receiving the loan.

Woveo helps you build credit history by reporting your lending circles’ payments to Equifax Pool and manage group money with anyone for free. Here’s how it works:

- Join Group: Complete your profile and join your group. No credit checks required.

- Pool Funds: Set loan amount and payment frequency for group. Receive loan when it’s your turn.

- Build Credit History: Payments are reported to Equifax. On-time payments positively impact credit scores.

Woveo’s approach to community savings and lending practices enables community organizers to pool funds, fundraise, and facilitate communal credit transactions. The app features social payments that facilitate communal transactions to empower community members, offer community incentives to drive community engagement with cash-back promotions via white-labeled physical and virtual cards designed to enhance the user experience.

“We’re excited to offer financial services that empower our community to build credit history and access credit opportunities,” say the cofounders.

Woveo was founded in 2021 by chief executive Jonah Chininga, operating officer James Muhato, and chief of technology, Sergio Fernández.

In 2022, the startup won the Digital Commerce Calgary Fintech Award hosted by Digital Commerce Bank and Platform Calgary.

Chininga is speaking at a Toronto fintech event, the 2023 Bankers Summit, in May.

Hi Knowlton,

Thanks for this great article and much appreciated. Wanted to make a correction note to the article. Woveo is located in Calgary, not Red Deer.

best