Toronto B2B fintech startup CapIntel has forged a new partnership with Empire Life, one of the top 10 Canadian life insurance companies.

CapIntel supports wholesalers and improves the day-to-day workflow efficiency and fund analysis for financial advisors.

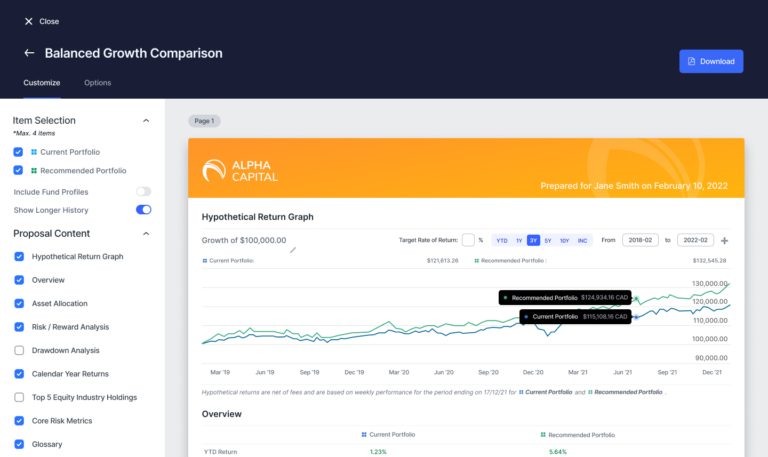

Empire Life will tap into CapIntel’s technology to enhance the value the sales teams bring to their advisor clients through improved fund comparison and analysis tools, and the ability to prepare personalized proposals.

For more than 50 years, Empire Life has managed investment solutions for Canadians with the goal of helping them build wealth, generate income, and achieve financial security.

RELATED: Q+A with CapIntel’s CEO James Rockwood on Holistic Wealth Management

Through this new relationship, CapIntel will support Empire Life to advance this goal by providing access to sophisticated portfolio analysis and comparison tools that enables the Empire Life wholesaling teams and financial advisors to easily build custom proposals and compare portfolios to deliver clear recommendations.

“Access to CapIntel will help streamline conversations and enable our team of professionals to demonstrate the investment value of Empire Life segregated funds alongside the benefits provided by our segregated fund contracts’ said Rob Popazzi, Vice President, Retail Distribution, Empire Life.

“Now more than ever, financial wholesalers need innovative solutions that support quicker, more intelligent insights for their advisor clients,” said James Rockwood, Founder and CEO of CapIntel.

“By introducing our platform to Empire Life’s team of sales professionals, we will build on their existing services with easy-to-gather data and custom proposals that will only further solidify them as a trusted partner to their advisor clients.”

Today, over 12,000 advisors and 800 wholesalers across North America use CapIntel to ensure their investment offerings and customer service provide clients with unrivalled results.

Leave a Reply