As Canada’s crypto craze continues, Ontario-based decentralized finance startup Wellfield Technologies this week announced the closing of an acquisition.

Wellfield acquired Tradewind Markets, a US-based operator of a global digital precious metals platform which offers blockchain-based digital ownership of deliverable precious metals held in custody by the Royal Canadian Mint.

“In many ways, today’s precious metals market still resembles the structure that has existed for decades, leaving persistent unmet needs for both investors and producers,” says Levy Cohen, chief executive of Wellfield. “For investors, the selection, purchase and storage of physical gold and silver products is confusing and comes with the expense of storing it safely.”

Even as digital solutions have emerged, “they do not serve the largest portion of the market, which is still focused on physical metals,” according to Cohen, who has experience leading technology-driven banking and payments companies in both Israel and Silicon Valley. “Tradewind’s solution offers the convenience and cost advantage of a digital solution, with the unique assurance that each digital ounce is backed by physically deliverable metal.”

“Tradewind was born of the idea that the marriage of physical precious metals and blockchain technology represents an unbeatable combination,” stated company director Ryan Graybill.

He believes “we are barely scratching the surface of this opportunity.”

“Wellfield’s technology and vision empowers us to expand our capabilities and leverage new opportunities that didn’t exist when Tradewind began its journey,” Graybill said.

The combination of Wellfield’s intellectual property and settlement capabilities with Tradewind’s trading and custody platform “will enable us to build a ground-breaking set of solutions targeted at these important investor and producer pain points,” Cohen affirmed.

As part of Wellfield’s acquisition execution strategy, it will expand the reach and services of key Tradewind technology such as VaultChain.

The company also intends to launch a regulated and blockchain-based spot market for gold and silver—which is expected to “draw liquidity into the ecosystem … and facilitate a direct connection between producers and investors, where quality gold of strong provenance will receive the premium it deserves, and where investors can have confidence they are purchasing precious metals that have been responsibly produced and sourced,” according to a statement.

Wellfield was active in the buyers’ market last year too, acquiring Israel-based Coinmama.

At the time of the transaction, Cohen anticipated “substantial synergies for the company.”

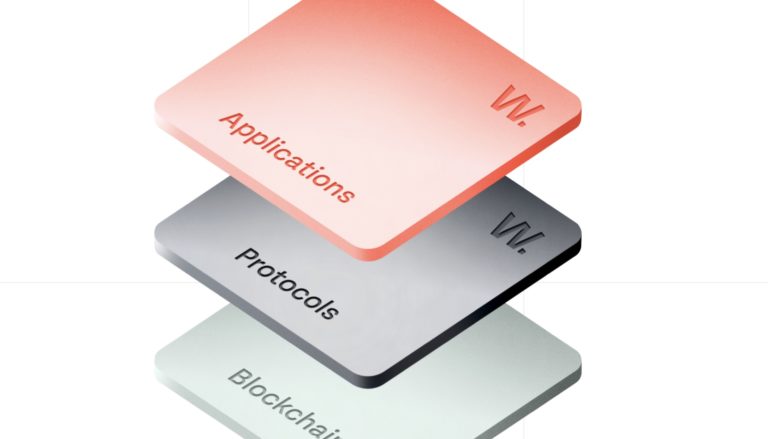

Wellfield is “positioned with all of the attributes required to achieve its mission to scale next generation financial applications powered by blockchain technology,” he stated.

Wellfield, which trades publicly on the Canadian Venture Exchange, was established in Markham in 2021.

Leave a Reply