Walnut Insurance this week announced the completion of a seed round.

$4 million in funding for the fledging fintech, which launched nationally from Toronto earlier this year, hails from ATB Financial and NAventures—National Bank of Canada’s corporate venture capital arm—as well as Harvest Venture Partners, Highline Beta, and N49P.

“Our seed raise is a testament to the continuing revolution inside the insurance industry,” stated Derek Szeto, a cofounder and chief executive of Walnut Insurance.

Szeto says that Walnut will use the seed funding to further expand strategic partnerships across North America and deliver “custom embedded insurance programs that enable brands to build deeper relationships with their customers.”

The Ontario startup offers modern insurance products—such as life insurance memberships with additional wellness subscriptions—through an all-digital platform.

“We are empowering partners to be able to offer innovative insurance products to millions of customers without the need for years of heavy investment or diversion of significant resources from other ongoing priorities,” says Szeto.

Embedded insurance is predicted to be a $3 trillion dollar market, according to the entrepreneur, “and Walnut is well positioned to be a leader in this industry.”

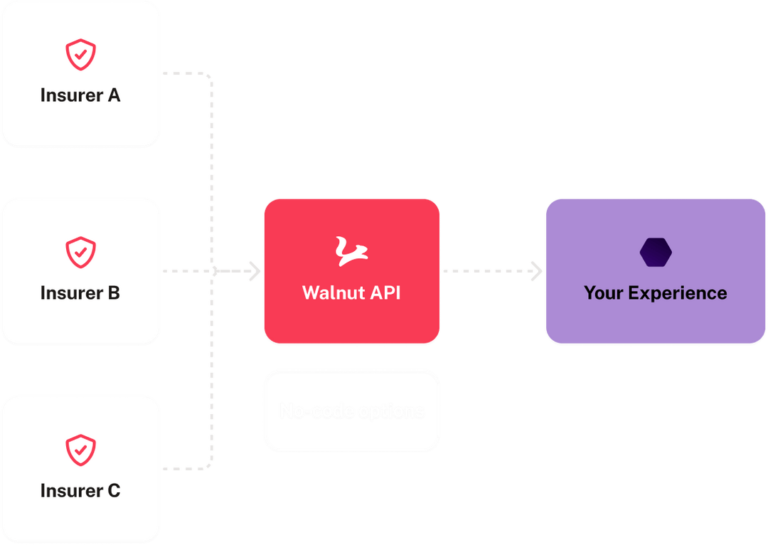

As brands look to build deeper relationships with customers and expand their revenue streams, Walnut provides core infrastructure and access to insurance products that can be embedded into or alongside consumer experiences.

Companies such as Nuula and Calgary’s Neo Financial have integrated with Walnut tech.

“We’re excited to be partnering with the team at Walnut, and to be a part of building a modern insurance infrastructure that can provide more meaningful and relevant insurance journeys to our consumers,” stated Neo Financial CEO Andrew Chau.

“Neo Financial is a leading example of how we work with partners to create embedded insurance offerings that support consumers’ daily lives, make insurance more accessible to the underinsured, and drive revenue for partners,” Szeto added.

The insurance industry is ready for disruption “and Walnut has built a powerful platform that will close the coverage gaps and create meaningful value for millions of people,” believes James Povitz, Principal at NAventures.

According to Povitz, the partnerships and distribution channels Walnut has been able to acquire at this stage of their business “is impressive and speaks to the need that Walnut’s fintech infrastructure is solving for partners and clients.”

Founded in 2020, Walnut believes its digital-first approach has flipped the insurance model to build an era of insurance that is marked by accessibility and transparency.

Leave a Reply