A Toronto-based insurance technology startup is bolstering its executive team with the addition of their first-ever vice president of growth.

Owl.co announced the appointment of Janae Tapley Sorenson to the all-new role, which will see the VP lead Owl’s business development, distribution strategy, and partnerships initiatives across North America, according to a statement from the fledging fintech.

“We’re extremely impressed with Janae’s experience, and more importantly her passion for connecting insurance leaders and experts with new ideas that are transformational,” commented Vahid Mirjalili, Owl’s chief operating office.

Prior to joining Owl, Sorenson held leadership positions in sales and marketing at global insurance carriers Lincoln Financial and BlueCross BlueShield. She also provided consulting in business development and growth strategies for global brokers Aon and Willis.

“We’re lucky to have her join our team and look forward to seeing her drive our growth initiatives,” the cofounder added.

Sorenson brings both corporate and entrepreneurial experience to the table, having cofounded First Impressions HQ, a company that provides training in presentation and sales skills.

“I see my role as a bit of an ‘evangelist’ for Owl,” stated Sorenson, who describes herself as a “change agent.”

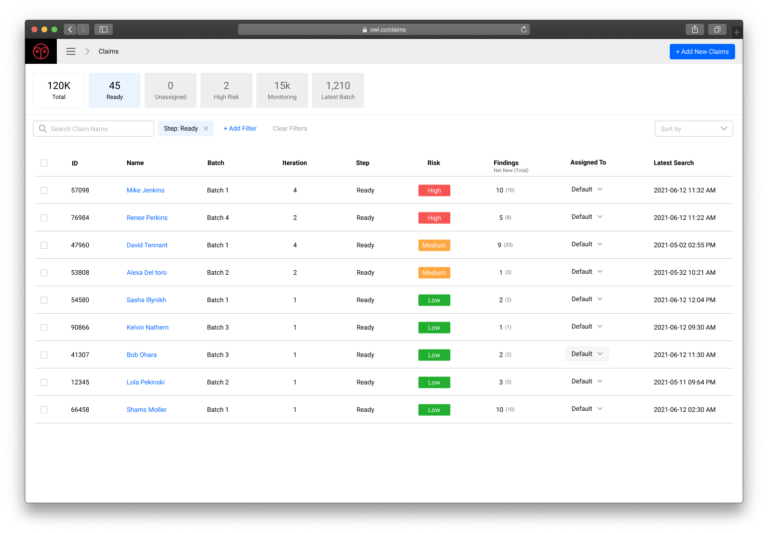

Mirjalili says Owl is building the world’s first real-time, intelligent platform for delivering insights from compliant, public domain information at scale.

“My aim is to help carriers understand why our claims technology is a game-changer for their business, helping them transform how they make claim decisions,” Sorenson said of her new position with Owl.

The startup’s technology “combines the power of machine learning with systematic analysis of thousands of public sources to provide unbiased evidence that transforms insurance decisions.”

Using this core tech, Owl offers three enterprise products revolving around: automated customer onboarding, enhanced due diligence, and advanced fraud detection.

“These solutions allow highly-regulated institutions to use disruptive technologies without sacrificing security or integrity of sensitive data,” the company states online, adding that “all this is done using zero-knowledge protocol, which basically means no one at Owl can see or access any sensitive customer data.”

Founded in Vancouver in 2018, Owl saw early momentum through 2019 and by the end of 2021 secured a $30 million Series B funding round.

The company currently works with several major organizations including the Toronto Stock Exchange, Fairstone, and some of the top banks and insurers in North America.

Leave a Reply