A Canadian property technology startup known as Wiseday Financial is aiming to upend Canada’s mortgage landscape by delivering the country’s first truly instant mortgage pre-approval process.

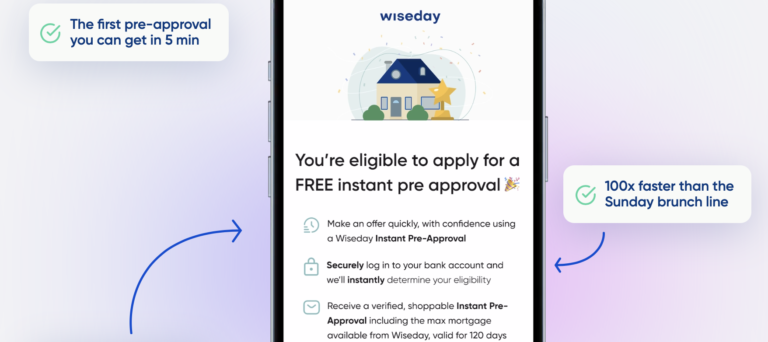

Securing a pre-approval from an established bank or traditional lender historically required piles of paperwork, numerous phone calls, and a wait time of up to seven days. Now Montreal-based Wiseday claims homebuyers can receive a usable pre-approved mortgage letter within five minutes.

“There’s so much talk of innovation in the mortgage space, but shockingly little has been done to improve the customer experience,” says Eric Dahan, CEO of Wiseday.

Most people want a quick pre-approval so they can start exploring their options, Dahan says. But in Canada, the process is “backwards.”

“Homebuyers have to jump through so many hoops before they can even begin looking,” the cofounder laments “We’re flipping the entire process on its head by eliminating the waiting.”

Dahan’s team built technology that breaks down a frustrating barrier that has existed too long in the home-buying process.

“The launch of our ‘on-demand’ mortgage approvals gives the power back to home buyers,” he says. “They can immediately learn what they qualify for and start looking for a home right away.”

After a series of qualifying questions, identity, income, and credit health are instantly verified. From there, a proprietary algorithm determines how much mortgage the customer qualifies for.

The company’s 100% online offering promises a zero-commission structure and exclusive rates.

Last year, the fintech startup secured $5 million in seed capital through Havery Capital, a venture company launched by Michael Bitensky, co-founder of Goli Nutrition.

“The founding team at Wiseday came with a clear vision of what had to change in order to make the mortgage process better for the next generation of homeowners,” Michael Bitensky, co-founder of Goli Nutrition and president of Havery Capital, stated.

Wiseday was founded in Montreal in 2021 by Eric Dahan, Andrew Peker (Head of Product), Stéphane Bischoff (Head of Engineering), and Tony Morino, (VP of Sales & Strategy).

Other fintechs disrupting mortgages and home buying in Canada include Nesto and Properly.

Leave a Reply