FrontFundr this week announced a significant growth milestone.

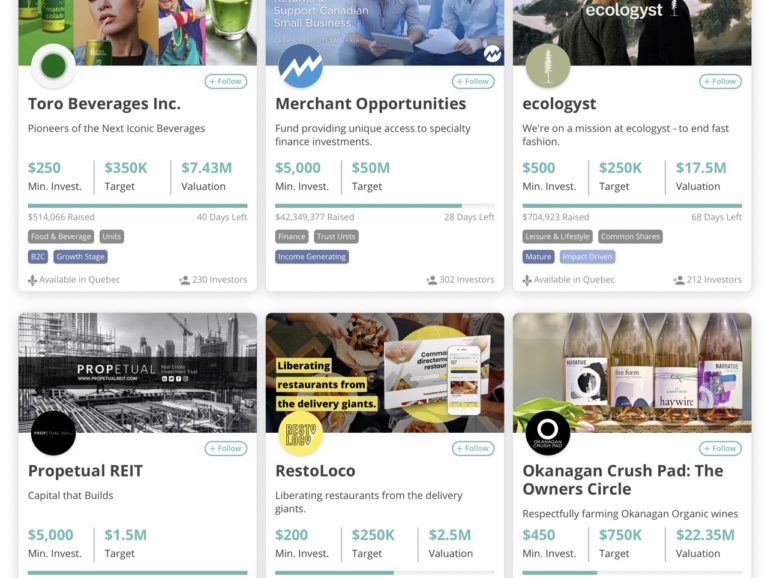

The Toronto-based equity crowdfunding platform says that is has surpassed 100 successful campaigns which have processed over $150 million in investments for startups in Canada. The fintech launched in 2015.

To mark this momentous occasion, FrontFundr launched its own fundraising campaign today, giving everyone the opportunity to invest in the platform itself.

FrontFundr says equity crowdfunding enables people and investors “to participate in early-stage investment opportunities that could potentially generate high returns while being mostly sheltered from external pressures like market volatility.”

When someone invests through FrontFundr, “the return on those investments are driven by the success of the company, rather than public market sentiment,” the company says. People can invest in companies they believe in and align with their values and interests. Despite the market downturn, investor activity is up 25% this quarter, according to FrontFundr.

“We’re incredibly excited to see equity crowdfunding succeeding here in Canada and poised to go mainstream,” said Peter-Paul Van Hoeken, Founder and CEO of FrontFundr. “Now that we’ve surpassed 100 successful raises on our platform, we see FrontFundr becoming the go-to platform for people to invest in Canada’s innovation economy while providing promising Canadian private companies access to capital from the public—and this is only the beginning.”

By listing itself on the marketplace, people have the unique opportunity to directly invest in the Canadian startup ecosystem. The campaign is now open until Friday, November 4th, 2022.

Companies such as Montreal-born fintech HardBacon have raised millions of dollars through FrontFundr. Seeking $500,000 in May, HardBacon’s most recent campaign raised over $700,000 from more than 500 investors across Canada.

“I’m grateful for the money we have managed to raise in just a few short weeks via our equity crowdfunding campaign,” Julien Brault, CEO of Hardbacon, stated at the time. “Equity crowdfunding is a healthy alternative to venture capital firms that have been withdrawing from the market as a response to the current economic turmoil.”

Leave a Reply