Toronto fintech startup Nuula has officially launched in Canada.

Starting today, Nuula will provide Canadian small business owners with a revolutionary way to monitor the performance of their business and access a range of financial products designed to serve their business, and their needs as business owners.

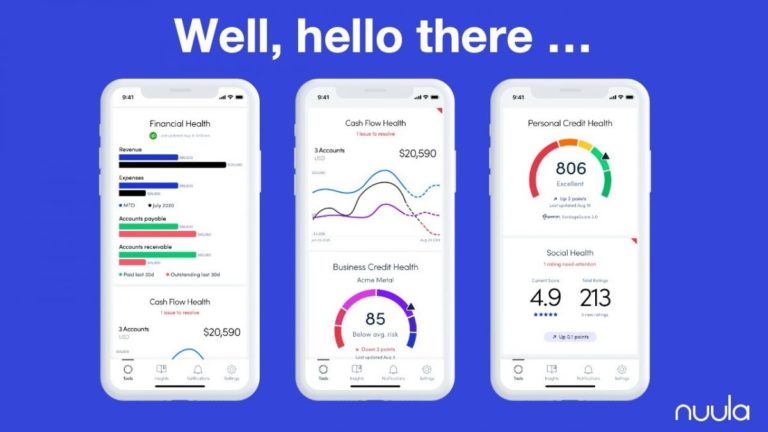

Nuula’s super app provides a range of critical features to help small business owners stay on top of what matters. It helps them track their cashflow in real time and alerts them to cash shortfalls before they happen. It helps them monitor critical financial and commercial metrics in a simple and easy to digest manner. It also makes it easy for them to track customer sentiment, including online ratings and reviews.

Complementing this, the app provides an integrated suite of financial products designed to serve both the needs of the business and the business owner. These include personal and business insurance, loans designed for businesses at different ages and stages, and smart credit cards which help automate and alleviate back-office overhead.

Rounding this out is an integrated wealth management offering that helps entrepreneurs grow and diversify their wealth.

“Nuula is based in Toronto, so we are particularly excited to bring this innovative financial service offering to our home market,” said Mark Ruddock, CEO at Nuula. “Nuula’s unique app-based approach delivers a suite of financial products and services that are designed specifically to meet the needs of small businesses, and the entrepreneurs who run them. This is a first for the Canadian market.”

Nuula is designed to seamlessly integrate best in breed products from a carefully curated ecosystem of partners. The company’s Canadian launch integrates two exciting new embedded financial products from Canadian companies, Caary Capital and OneVest.

“Small businesses are at a disadvantage when it comes to financial service offerings and access to capital. That’s why innovative fintechs like Nuula are so important,” said John MacKinlay, CEO at Caary Capital.

“Channel partnerships have been a key focus of our market entrance and we are pleased to report that Caary’s corporate credit card will now be offered in the Nuula app to Canadian customers. It’s great to team up with another Canadian fintech that is equally dedicated to serving Canada’s small business community.”

“OneVest is proud to deliver a modern wealth management service through the Nuula app,” said Amar Ahluwalia, CEO at OneVest. “Entrepreneurs deserve better, more convenient options to make their capital work for them. OneVest, embedded into the Nuula app, will provide Canadian small business owners with an easier way to invest and grow their wealth.”

Last month Nuula partnered with Toronto neighbour Walnut on a wellness feature that gives small business owners access to life insurance, meditation programs, and online fitness classes for under $10 per month.

Nuula is now available in the U.S. and all provinces in Canada except Quebec and plans to launch in the U.K. in late 2022.

Leave a Reply