In the past decade, we’ve seen Canadians enjoy enormous equity gains in their homes and decade-long sky-high home prices. When we couple this with increased interest rates, the option to upsize or upgrade your home is diminishing for many Canadians. For the time being, renovations of existing home properties are the way to go.

It’s not just the cost of buying that leads Canadians to renovate. The majority of Canadians renovate, intending to make their home more functional for resale, for their changing family needs, or their long-term enjoyment. Interestingly, current research shows that 92% of Canadians aged 45+ hope to age in place. Those staying put may also turn a part of their home into rental space to gain additional income or to accommodate inter-generational suites. So how do you decide if you should renovate during this time? Here are some tips:

Think about the ROI (return on your investment).

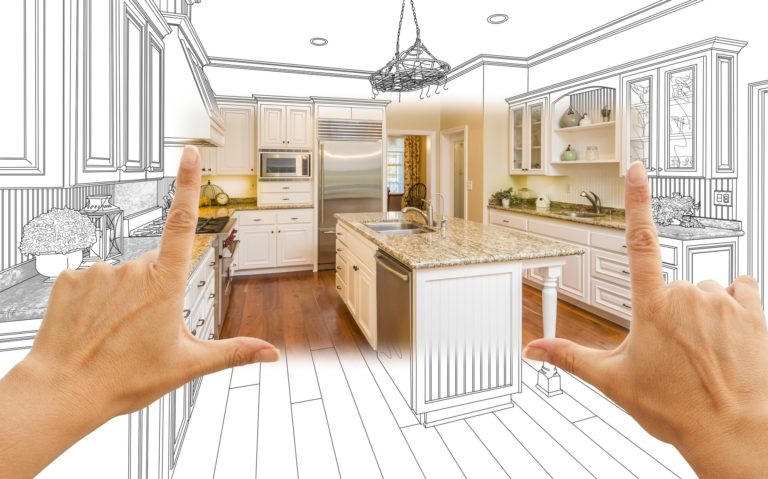

Several home improvement projects are considered ROI positive, meaning the money spent on your home renovation will increase the value of your home at the point of sale by at least what you’ve put into the renovation. HomeStars cost guide research shows that home renos like kitchens and bathrooms have 100 percent ROI. For example, if you were to renovate your kitchen for $30,000, the reno could add that amount to the value of your home.

At a time like this, when the cost of money is high, Canadians need to be strategic when completing home renovations. Ensuring the renos increase the value of your home is a great way to get your money back on your investment while keeping your home up-to-date and supporting your family’s needs. Many Canadians have been through financial hardships throughout the last few years, and others are widely feeling the current economic pressures, so making the decision to renovate is a tough one. Leverage ROI data to empower your decision-making and guide your investment decisions.

If you don’t have the cash on hand, you’re not alone.

Quite simply, the cost of cash is increasing. Last week, Bloomberg reported that 55% of Canadian homeowners are strapped for extra costs. HomeStars research shows that in 2020 and 2021, 20 percent of homeowners didn’t have cash on hand to carry out the renovations they needed. With the ongoing market volatility, we believe that this number will climb close to 30 percent meaning more homeowners will need to lean on personal loans, lines of credit, and other short-term lending options to facilitate home renovations.

Unfortunately, this likely means the cost of home renovations will remain high over the next few months. Supply chain issues and the high cost of materials persist, and though they likely will be relieved in the next six months or so, the cost of gas and price of labour will continue to be high.

In these trying times, Canadians need to know what their options are. You ultimately must decide what you need and want your home to provide over the next three years. If moving is your only option, you may need to purchase a less-ready home and get additional financing for renovations up front in your mortgage. If you can sit tight for a few more years and make a few modifications to suit your needs, you can do so and still add value to your home for a better selling price down the line.

It will be integral for Canadians to think about the renovations they need to do versus what they like or want to do. If discretionary spending is desired and accessible, it is in your best interest to ensure that the investment is for a project that will yield a good return when you sell your home.

With that being said, discretionary home spending is slowing down, which is a normal trend during an inflationary period; however, there are some home renovations that can not be put on hold. Many Canadians are in positions where they need to accommodate intergenerational suites or their changing family. For families who need to make these home improvements, it’s integral that you know your financial options to not only support these changes but to provide financial flexibility for your family.

So, how can you afford home renovations?

While everyone has a unique financial situation and should adequately assess their options, homeowners who have had their homes since before the pandemic are likely sitting on significant under-utilized home equity that can be leveraged for home renovations and repairs.

HomeStars’ mission for 16 years has been to support Canadian homeowners in their home reno and repair journeys. With the increased cost of borrowing money and no signs of the increases slowing down, the HomeStars team wanted to ensure it was stepping in to empower Canadians during these trying times. That’s why HomeStars developed an alternative financing option to help support Canadians in their home renovation and improvement projects.

With the HomeStars and Perch partnership, Canadians can use under-utilized equity in their homes to fund their renovations. The added benefit of refinancing is that homeowners typically get a significantly lower rate than a short-term loan, spread over 25-30 years. Meaning Canadians’ monthly payments on the total amount will be considerably lower while still adding value to their homes.

Through all of this, there are two important things to remember. First, it’s in your wallet’s best interest to renovate strategically. Prioritize projects with the highest ROI, like kitchen and bathroom renovations, to ensure you utilize the investment into your home for future equity.

Second, if you, like some Canadians, are worried about your cash on hand, renovating your home is not out of reach. Look into your refinancing options and leverage ready-available tools like the HomeStars x Perch tool here.

Shir Magen is the CEO of HomeStars, Canada’s largest network of verified and community-reviewed home service professionals.

Leave a Reply