A financial technology startup that launched in Canada at the start of this year has raised a round of seed capital.

Brio is a new fintech with presence in Toronto and Montreal. The company’s platform targets general partners in the venture capital space, as well as private equity investors and multi-family offices.

The company recently closed $3M, according to a report from BetaKit, in a seed round led by Montréal-based Walter Global Asset Management and Toronto’s Canso Innovations. The startup’s valuation was not disclosed.

Also participating in the round was Brightspark, from which Brio spun out in January.

Brio was cofounded by marketing lead Émilie Parker Jones, chief of tech Ab Fadel, and chief executive officer Audrey Ostiguy, who began building the entity as Brightspark’s fund operations manager in a bid to better manage partner relationships through software.

Over time the internal tool caught the interest of outside VCs and other asset managers, which eventually spurred Brightspark to release Brio as an independent platform of which it owns a majority stake.

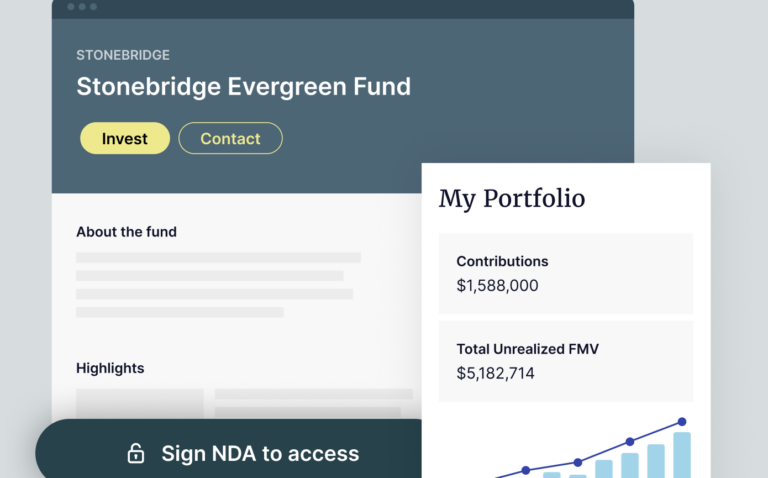

Brio’s offering is a white-label solution that aims to save investors time by centralizing partner management and automating deal marketing, onboarding, compliance reporting, and more.

“We understand firsthand the operational challenges faced by alternative asset managers and immediately appreciated how Brio’s proven technology directly meets those needs,” Walter GAM managing partner Julie Lalonde said in a statement to BK. “Brio’s comprehensive platform is what the industry has been waiting for.”

Brio intends to apply the seed capital toward growing its team across product and sales, as well as improve its technology stack, according to BK, with an aim to become “the definitive operational backbone for alternative asset managers.”

Brightspark Ventures has been investing in early-stage Canadian technology firms and since it was founded in 1999. The company currently boasts more than $500B in assets under management.

Leave a Reply