Investment into financial technology in Canada remains “robust,” a new report from KPMG shows, elevated by a select few major deals.

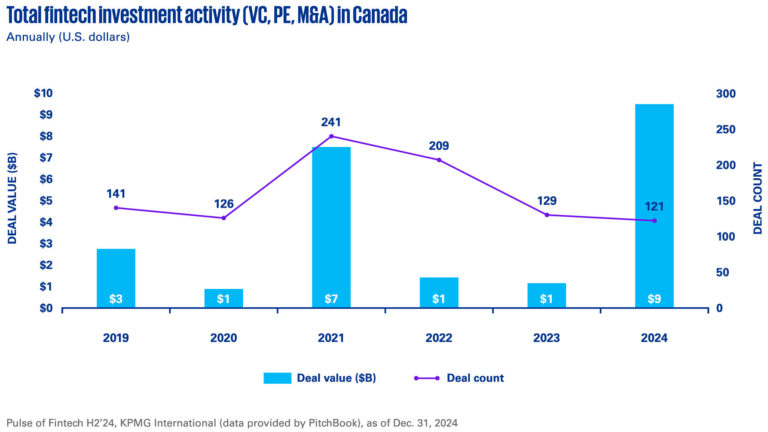

A record US$9.5 billion was invested across 121 fintech deals last year, according to data compiled by PitchBook, compared to US$1.1 billion invested a year earlier across 129 deals.

Diving deeper into KPMG International’s H2’24 Pulse of Fintech report, we learn that one investment accounted for a majority of last year’s total: the US$6.3B take-private deal for Montreal’s Nuvei. This was not just the largest deal in Canada but also the year’s second largest globally.

In a distant second, a US$1 billion private equity investment into Montreal’s Plusgrade was the second biggest contributor.

Minus the Nuvei and Plusgrade deals, total investment in Canadian fintechs (including venture capital, private equity, and mergers and acquisitions) totalled more than US$2B last year, still nearly double the 2023 figure, and higher than the US$1.4 billion invested in 2022.

“Canada’s fintech sector is punching above its weight globally,” believes KPMG partner Dubie Cunningham, citing “strong interest” from both venture capital and private equity investors.

During a year “where global investment was weak,” Cunningham positions Canada’s year as a “significant achievement.”

Momentum did slow through the year, however, with nearly 80 deals in the first six months versus just 45 in the second half of the year.

In terms of venture capital, investors poured a total of US$1.09B into Canadian fintechs across 90 deals, compared to US$740M invested across 103 deals in 2023.

Notable VC investment rounds into fintechs include Koho’s $190M raise and Neo Financial’s huge year.

Moving forward, KPMG forecasts an uptick in fintech investment in Canada. However, much of this investment could continue to come in the form of take-private deals, suggests Georges Pigeon, a partner in KPMG in Canada’s Deal Advisory practice in Montreal.

“We’re seeing some publicly-traded fintechs contemplating privatization because it’s easier to manage growth without the regulatory burden of public markets,” he explains. “Also, the lofty valuations of 2021 have come down, and that’s proving difficult for fintechs that went public around that time, so they might be looking at the private market again.”

The most popular fields of fintech attracting investment are crypto and blockchain (34 deals); artificial intelligence and machine learning (19); and payments (14).

These spaces are expected to remain popular, but future investors will be more value-focused than in the past, regardless of vertical.

“Investors have capital to deploy in Canadian fintech, but fintechs will need to have a very strong value proposition to get funding,” Pigeon says. “The fintechs that can demonstrate an ability to solve a problem for financial institutions and their legacy technology, that can acquire and retain clients, and that report decent profits will be more attractive to investors.”

Late stage venture capital saw 34 deals, more than early stage (27) and seed rounds (26). The year saw 14 mergers and acquisitions and 13 buyouts.

Check out the previous Pulse report from KPMG here.

Leave a Reply