Conquest Planning is ending a strong year on a high note as the Winnipeg-based financial technology upstart announced this week that it has surpassed one million plans provided through its wealth management platform, a major milestone for the firm.

The figure follows market expansion from Canada into both the US and UK.

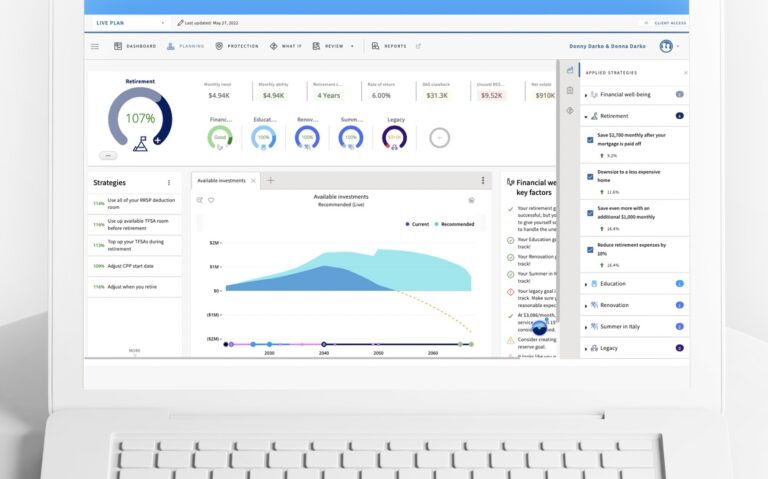

Conquest’s artificial intelligence powered software empowers institutions to offer financial advice at scale, from mass-market clients to ultra-high-net-worth individuals. Leveraging its AI engine—the Strategic Advice Manager, or SAM—Conquest serves financial advisors, banks, brokerages, wirehouses, insurance firms, and pension providers.

“What began as a simple whiteboard session and a vision to make financial advice accessible for all has grown into a powerful, intuitive financial planning technology that’s transforming how tens of thousands of professionals guide their clients toward financial security and success,” says Mark Evans, who founded Conquest in 2018.

Conquest was also recently recognized by Manulife and the World Economic Forum’s Prospering in Longevity Challenge, in addition to a slew of other notable accolades throughout 2024: Placing 27th on Deloitte Canada’s Technology Fast 50 list, for example, as well as ranking among Globe and Mail’s Top Growing Companies and returning to CB Insights’ Fintech 100.

Evans believes these achievements reflect Conquest’s capacity to successfully fill key gaps in the traditional finance sector.

“Throughout my long tenure in the industry, I’ve seen the technology and client experience gap in financial services widen globally,” explains Evans. “Conquest has stepped in to bridge that gap, providing a modern, adaptable solution that allows financial plans to evolve alongside savers, spenders and investors as they navigate each stage of life.”

With a majority of the Canadian financial advisor market already locked down, Conquest is “rapidly gaining adoption in the US and UK,” according to a statement from the firm.

What sets Conquest apart, says chief revenue officer Brad Joudrie, “is our dedication to enhancing the advisor and client experience with technology designed to empower any investor.”

“Our platform provides advisors and end clients with a modern, technology-forward solution to create interactive, collaborative plans while giving clients a clear, actionable path to their goals,” he says. “Through automation, real-time monitoring and personalized recommendations, we’re helping clients at any stage of life thrive in a digital world and instilling confidence in clients as they pursue their financial journeys.”

Recently, the firm has inked partnerships with large institutions, including Raymond James in Canada and PlannrCRM in the UK.

Leave a Reply