A digital financial platform targeting Canadian businesses recently announced the launch of Interac e-Transfer payments.

Toronto’s Vault says this was a “heavily-requested feature,” one which will “significantly expand the platform’s payment capabilities” by allowing customers to send payments via Interac through the Vault platform.

“While many businesses rely on wire and local transfers, we have learned that many of our customers—and specifically small business owners—prefer to use Interac when making payments, and we’re excited to provide the option to our customers,” explains Ahmed Shafik, a cofounder of Vault.

“We love listening to and building for our customers because they know better than anyone else how we can improve the lives of our fellow Canadian business owners,” the entrepreneur added.

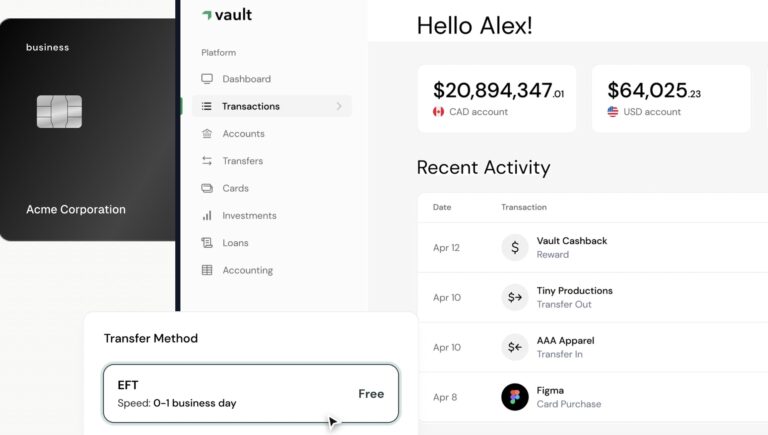

The e-Transfer option complements Vault’s existing payment methods, including local transfers through their existing multi-currency accounts (e.g., EFT, ACH, SEPA) and international wire transfers.

By offering a range of financial products such as multi-currency accounts, global bank transfers, automated accounting, and corporate cards, Vault enables business owners to manage their entire financial operations on a single platform.

The platform also integrates with QBO and Xero so far, with more integrations coming “soon.”

Vault was founded in Toronto in 2021 by Shafik and Saud Aziz and launched in Canada last year.

“Aziz and I have parents who are small business owners; we experienced first-hand the antiquated banking services that constrained their ability to freely manage how they spend, move and manage their money, all while enduring excessive fees,” Shafik recalled in 2023. “We founded Vault to change this.”

The Canadian fintech startup has been bolstering its suite of offerings through 2024.

Leave a Reply