It is estimated that more than three million people aged 18-plus in Canada are “credit invisible,” according to Equifax, meaning these individuals either do not have a credit file or the credit information on file is insufficient to generate credit scores.

An additional seven million may have two or less credit accounts on their credit file, which is considered limited credit history—a “thin” credit file.

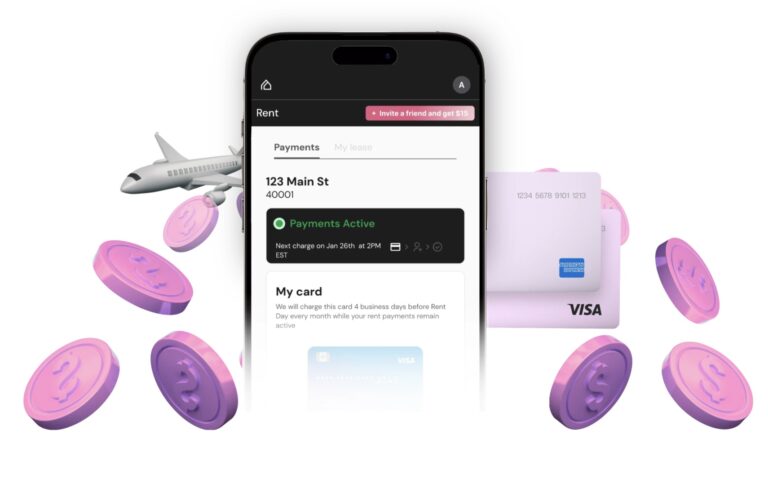

Toronto’s Chexy, a platform dedicated to tenant benefits, is helping address this issue by turning rent payments into credit building practices and reward opportunities.

With Chexy, renters have the flexibility to pay their rent using credit or debit cards, earning rewards like cashback and points through existing card programs.

“We’re excited to offer renters a solution that turns rent into more than just a payment—it’s now a way to build financial momentum,” says Liza Akhvledziani, cofounder and chief executive officer of Chexy.

Nearly one-third of Canadians rent their homes, over 10,000 of whom so far use Chexy, which has processed more than $200 million in rent payments since launching the platform in 2023.

“Our mission is to empower Canadians to make the most of their rent by turning it into rewards, credit-building opportunities, and even cashback,” Akhvledziani says. “With Chexy, renters can see real financial benefits and feel more in control of their financial future—and rent is just the beginning.”

Last year, Chexy raised a $1.3 million financing round led by Crossbeam Ventures after joining Intuit’s Prosperity Accelerator in Toronto before winning $50,000 at a DMZ pitch event then making waves at Collision.

Moving forward, Chexy plans to enhance its suite of offerings. For example, in 2025, users will be able to pay household bills through the platform, according to Akhvledziani.

Leave a Reply