Founded in Toronto in 2022 by Mark Levitan and Bruce Hodges, Parachute offers loans online and helps consumers improve their financial wellness through debt management, financial literacy education, and other digital tools.

After going through the Intuit Prosperity Accelerator in 2o23, Parachute recently revealed the raise of a seed round.

The $1.5 million round, first reported by BetaKit, brings the startup’s total capital raised to more than $2M.

The latest investment hails from Adrenaline Fund as well as Highline Beta, which participated in a previously undisclosed pre-seed round, and unnamed angel investors.

Parachute provides simplified debt consolidation, which can immediately assist financially struggling Canadians. But even loans with reasonable terms don’t address the root causes of many financial issues.

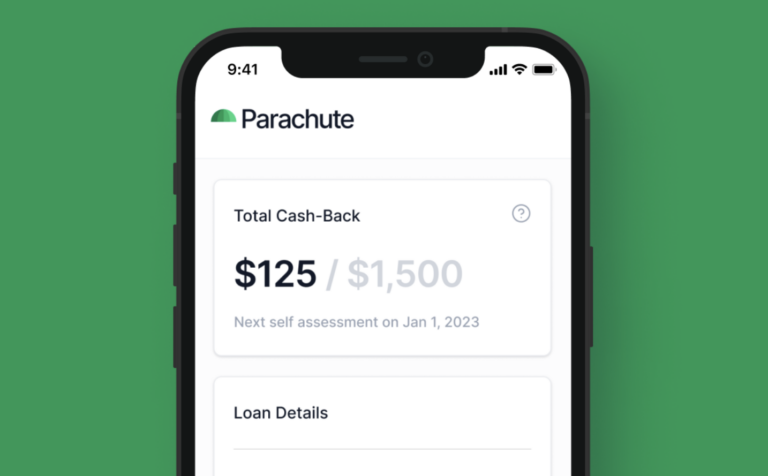

Therefore, the company also combines financial technology and behavioural science in a bid to drive positive change among consumers’ habits. This approach includes a rebate system that aims to incentivize wiser financial decisions with rewards.

“Our three step program empowers, educates, and rewards our customers,” the company states. “We offer the only loan where someone can leave with more savings than when they started.”

Moving forward, the Canadian fintech is focused on maximizing its market reach in Canada, according to BK.

Parachute, which has primarily sold its services directly to consumers thus far, is also now discussing potential partnerships with credit unions.

“Many of them [Credit unions] have excess capital they want to deploy, we need access to distribution, [and] we need access to capital, so it’s a perfect match,” Hodges told BK.

Leave a Reply