Building on an initial rollout in the U.S. market, Hiive last year released its online marketplace for private company stocks in Canada.

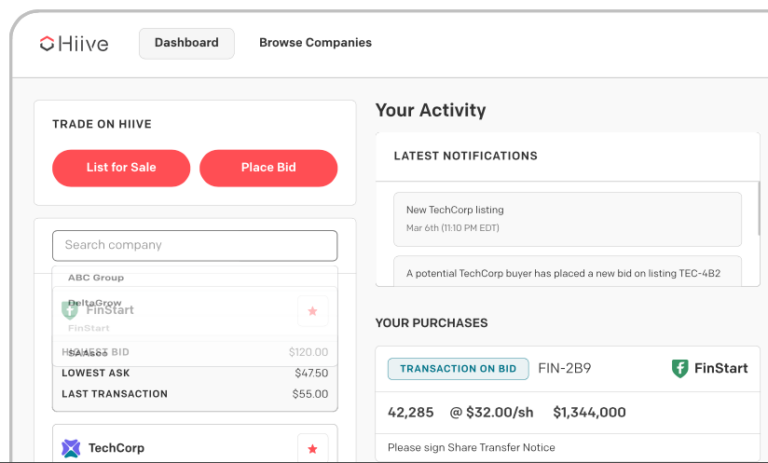

The Vancouver-born marketplace functions as a meeting place for buyers and sellers of shares in privately held companies, typically those backed by venture capital.

Accredited investors and funds can place an order to buy or sell shares directly from other parties without needing a live broker because Hiive automates and centralizes the processes usually carried out in traditional secondary markets.

Following a capital raise in late 2023, Hiive recently revealed a milestone.

The B.C. fintech announced over the weekend that it has surpassed $1 billion in completed transactions.

“This milestone is a testament to the trust our clients and partners place in us, as well as the dedication of our team,” stated cofounder Prab Rattan on LinkedIn.

Rattan posits that “traditional exit paths for VC-backed companies remain relatively shut.”

Hiive, meanwhile, continues “to be laser-focused on being the all-in-one liquidity solution for private companies and their shareholders,” making it an attractive alternative to incumbent pathways.

According to Rattan, Hiive is now closing more than $100 million in transaction volume per month, suggesting the next milestone may not be far away.

“Exciting times ahead,” he posted.

Leave a Reply