VoPay this week launched a new vertical targeting the insurance industry.

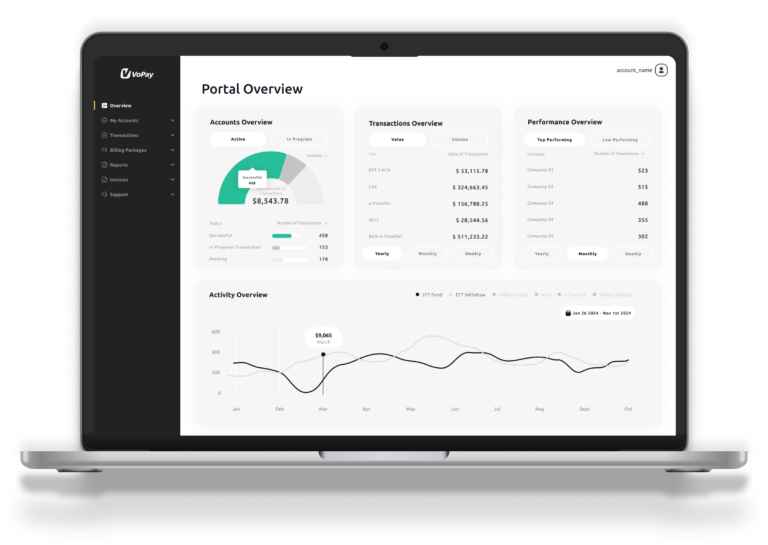

The Vancouver-based fintech now provides a platform that simplifies the complexities of embedding financial services into insurance platforms. VoPay’s API enables companies to integrate payment capabilities, manage risk, ensure compliance, and scale without the need to build and maintain infrastructure.

With a focus on insurance carriers and managing general agents, VoPay’s latest solution arrives during “an era where efficiency and transparency are paramount,” according to a statement from the fintech, which says the insurance industry “faces significant challenges due to reliance on multiple, disconnected systems for policy administration, payments, and financial reporting.”

For example, carriers receive financial reports weeks after the end of a month, hindering decision-making and risk management. As a result, a real-time understanding of financial performance and potential liabilities is nearly impossible, making it difficult to manage risk and identify growth opportunities proactively.

“Our solution eliminates the manual work and inefficiencies that create daily headaches and hinder operations,” reads a statement from VoPay. “By automating policy administration and payment tasks, we offer a unified platform that replaces disjointed, manual processes from start to finish.”

Hamed Arbabi, the founder of VoPay, says his team understands “the unique challenges faced by the insurance industry.”

“We’ve tailored our agnostic technology to directly impact the pain points experienced by MGAs and carriers,” Arbabi, CEO, said. “By providing real-time financial clarity and automating key financial processes, we’re helping carriers and MGAs digitally transform their operations quickly and efficiently, freeing up time to focus on scaling.”

Automating the premium collection process, VoPay extracts essential policy details and generates invoices and debit authority requests directly from the policy administration system. In addition, VoPay’s Claim Management module supports carriers in distributing and adjusting claims.

Founded in 2015, VoPay has collaborated with other fintechs, including a partnership with fellow Canadian Parvis Invest as well as one with U.S. payments titan MasterCard.

The B.C. upstart is currently expanding into the U.S. market with eyes on Europe next.

Leave a Reply