Research by the World Bank Group across 109 economies reveals that 30% of small businesses in the formal private sector are credit constrained. Limited access to working capital for small businesses negatively impacts the economy, growth, productivity, and employment. Small businesses are crucial for wealth creation, equity, and financial inclusion, especially among underserved groups.

Encouraging small business formation promotes economic expansion and helps narrow gender and racial wealth gap. Business equity is the second-largest source of wealth for households, with business owners having a median net worth more than double that of non-owners. This wealth gap is even more pronounced among owners of color, with Black women entrepreneurs having a median net worth ten times greater than non-owners.

Lack of Affordable Credit

For small businesses, lack of access to credit has severe consequences, leading them to seek high-cost options. Small businesses are in desperate need of timely capital and therefore access options that are not conducive to their cash flow. The challenge is not just access to credit, but access to affordable credit.

Minority owned businesses face greater challenges accessing credit from traditional sources due to perceived higher credit risks, lower owner wealth, lower business revenues, and insufficient credit histories. Women-owned small businesses also face difficulties due to smaller size, risk aversion, and a gender gap in financial knowledge. Migrant entrepreneurs may encounter discrimination and lack of understanding from financial institutions, further hindering their access.

Overcoming Data and Technology Challenges

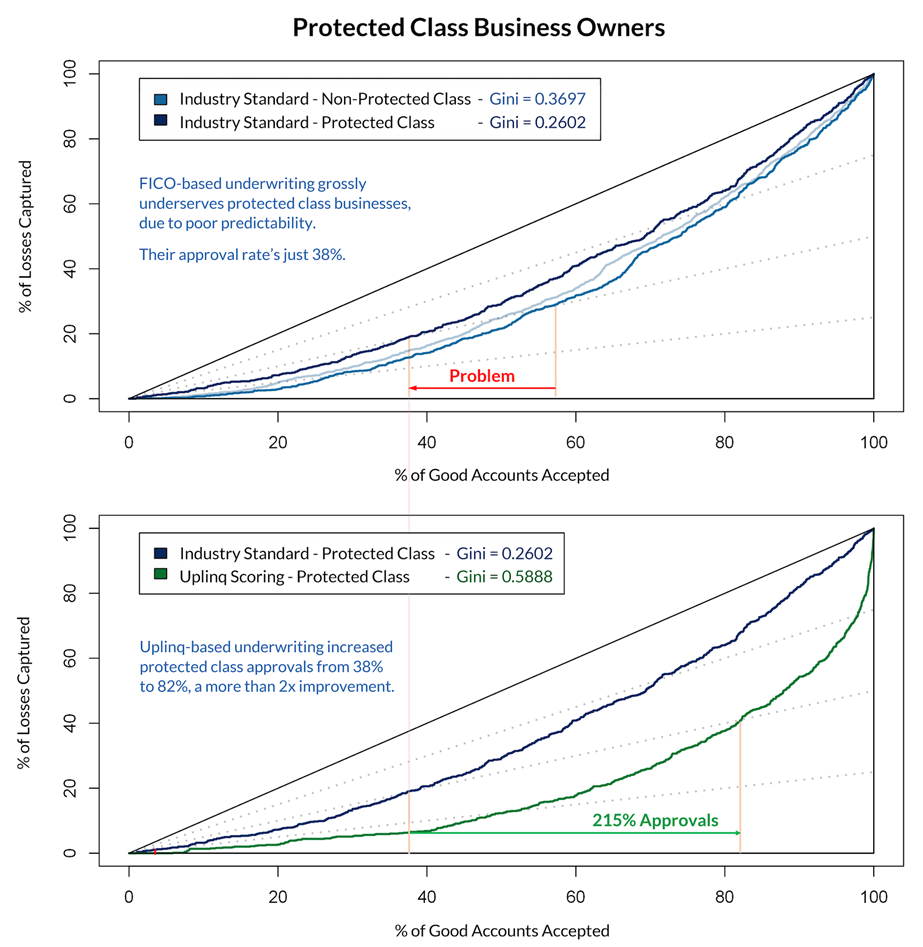

Data challenges are at the heart of fair and accessible lending for small businesses. Relying strictly on industry standard scores for small business loan underwriting can unfairly impact protected class business owners. Expanding the set of data inputs used to evaluate small businesses, including data from accounting systems, payment, eCommerce systems, core banking platforms, and other sources, could increase the number of good loans accepted by 215% as outlined in a recently released Whitepaper Fair and Accessible Credit for Small Businesses by Cornerstone Advisors.

The Use of AI Technology in Small Business Lending

A 2022 study by Visa found that majority of financial institutions still rely on manual underwriting processes for small business lending unchanged from a 2010 study. Those that use automated decisioning can auto-decision 50% to 60% of application volume, leading to consistent decisioning speed, cost reduction, and stable risk performance. Furthermore, it can result in higher penetration rates, lower acquisition costs, stable risk performance, and adherence to regulatory expectations.

AI Machine learning models can increase credit access by accurately identifying applicants likely to repay loans and reducing the number of people given loans they are unlikely to repay. But financial institutions need to be overcome certain challenges in deploying AI models:

- Explainability: Understanding how and why a model arrives at a particular decision is crucial. Lenders must ensure explainability in their machine learning models to comply with regulatory requirements, address customer inquiries, and maintain trust.

- Transparency: The black box nature of machine learning models necessitates transparency in credit decisioning to explain why certain applicants are denied credit or receive different interest rates.

- Data Availability and Quality: Machine learning models rely on large volumes of high-quality data for training and validation. Financial institutions may face challenges in accessing and aggregating diverse and relevant data sets.

- Model Validation and Bias Mitigation: Models must be thoroughly evaluated to ensure they do not perpetuate biases or discriminate against certain demographics. Robust validation processes and addressing bias concerns are essential for fair lending practices.

One of the key aspects in bringing acceptance to varied data and technological evolution is willingness to change and adaptation. How can we help those accustomed to traditional ways? The answer lies in the underlying culture.

Access to credit for small businesses is a big opportunity for lenders. Lenders should be willing to experiment and embrace change. Risk assessment that considers the realities on the ground, address biases, treats borrowers fairly and enables access to affordable and timely financing for small businesses is the need of the hour. Solutions that will help lenders enable financing while ensuring appropriate risk mitigation and regulatory compliance is the way to solve this challenge.

Abhishek Bhasin is the Head of Product at Uplinq Financial Technologies with over 15 years of experience in financial services, including product management, lending, strategy, and impact investing. He spent eight years as a business lender at RBC and Oikocredit, which supports microfinance institutions and MSMEs in over 70 countries. Abhishek has also worked with credit bureaus TransUnion and Equifax, gaining expertise in financial systems. He specializes in credit structuring, alternative data, AI/ML-driven lending, open banking, and financial inclusion, which he is passionate about promoting throughout his career.

Leave a Reply