Montreal-based crypto exchange Shakepay has announced two significant new hires: Sabrina Tricarico as Head of Marketing and Jessica Raybeck as Head of Trading & Sales.

According to the Montreal-based crypto exchange these additions are key to Shakepay’s plans to expand into the institutional market and grow its product lineup.

This leadership expansion highlights Shakepay’s dedication to broadening its customer base, which ranges from individual users to large institutional investors.

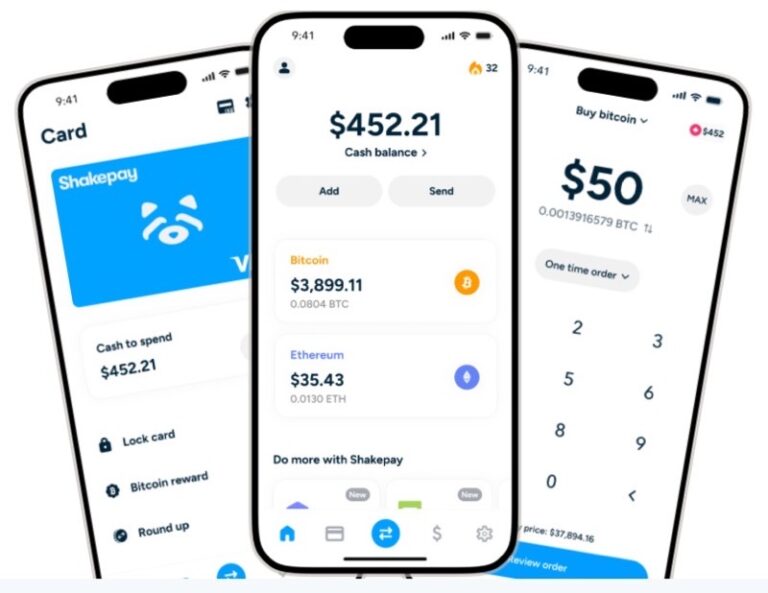

Shakepay is rapidly growing, already serving over 1 million customers with services like direct deposits, bill payments, and e-transfers. With these new hires, the company is positioned to enter new markets and solidify its role in Canada’s fintech industry.

RELATED: The Future of Qualified Investments in Canada: Why Bitcoin Belongs in Your RRSP

Sabrina Tricarico will lead Shakepay’s marketing efforts, targeting a wider audience, including institutional clients. With over 13 years of experience in growth marketing, Sabrina has a proven track record of success. Previously, as Head of Marketing at Figment, a leading blockchain staking provider, she helped the company grow its assets under stake to over $15 billion. At Shakepay, she will focus on expanding the company’s brand presence and driving customer acquisition in both retail and institutional markets.

Jessica Raybeck will head Shakepay’s institutional expansion as the new Head of Trading & Sales. She will oversee the development of Shakepay’s Over-The-Counter (OTC) trading services, providing customized solutions for high-net-worth individuals, corporations, and financial institutions. Jessica brings extensive experience in both digital assets and traditional finance, having held leadership positions at Polytope Research and BlockFi. Her expertise will help Shakepay build a strong presence in the institutional trading space, offering high-volume, personalized trade execution.

These hires come at an important time for Shakepay. The company is working towards becoming a Canadian Investment Regulatory Organization (CIRO) dealer member and registering as a Payment Service Provider (PSP) under the Retail Payments Activities Act (RPAA). These steps are designed to enhance Shakepay’s regulatory compliance, enable new product offerings, and strengthen its position as a trusted leader in Canada’s digital finance sector.

“We’re excited to welcome Sabrina and Jessica to the Shakepay team,” said Jean Amiouny, CEO of Shakepay. “Their expertise in marketing and trading will be invaluable as we continue to grow, navigate regulatory challenges, and expand our services for both retail and institutional clients.”

Leave a Reply