A wealth management technology company based in Canada announced this week the launch of a revenue management and billing solution that is fully integrated into the firm’s flagship enterprise platform.

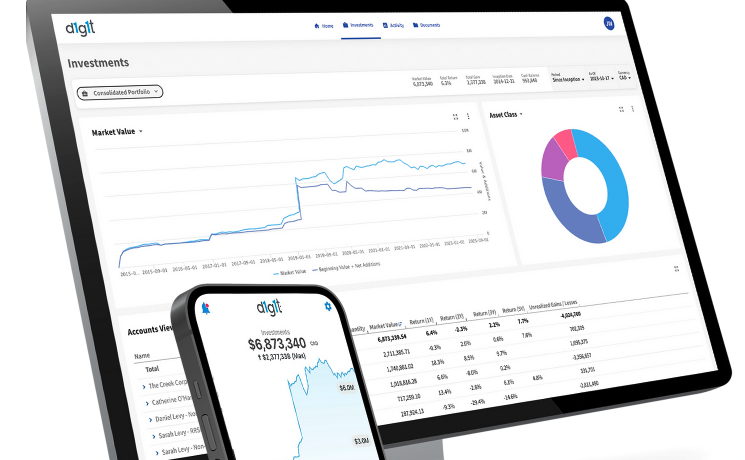

Aiming to meet the needs of different types of wealth management firms, d1g1t’s billing solution is powered by a multi-currency, scalable calculation engine that supports complex billing scenarios.

Toronto’s d1g1t now supports payments in arrears and in advance, tiered and fixed fee schedules, various asset calculation methods, and more, according to Benoit Fleury, a cofounder of the fintech startup.

“With our focus on driving continuous innovation, we are excited to bring to market a sophisticated billing solution that delivers personalization at scale and drives significant operational efficiencies for our customers,” Fleury stated.

“Embedding billing directly into our platform’s integrated workflows streamlines the entire wealth management lifecycle,” the chief of product continued.

“For firms seeking ways to spend more time engaging on strategic high value activities and less time on back-office administrative tasks, our solution drives flawless billing cycles and modernizes the revenue management process,” said Fleury.

Chicago’s Gresham, which provides investment and wealth planning services to a group of high-net-worth individuals and families across approximately $9 billion in assets, tapped d1g1t in April.

More recently, Victoria’s Burkett Asset Management implemented d1g1t‘s enterprise wealth management platform. Burkett manages over $300 million in institutional and private client assets.

d1g1t was founded in 2016 CEO Dan Rosen alongside Philippe Rouanet and Fleury.

Leave a Reply