Following graduation from the Intuit Prosperity Accelerator last year, NetNow this month secured pre-seed funding.

The $1.8 million round into NetNow was led by Toronto’s Ripple Ventures and included participation from Centre Street Partners, Antler, Motivate Venture Capital, and Day One Ventures.

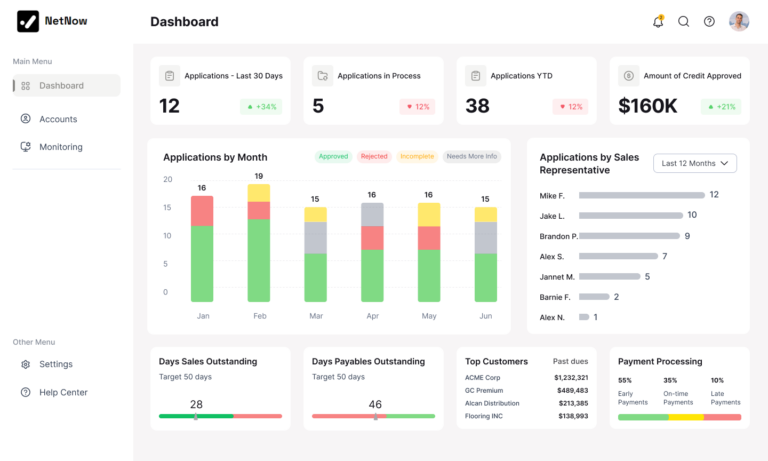

The Toronto fintech’s flagship offering is a modern trade credit platform that automates the credit and collections process for wholesalers and distributors.

“Everyone deserves to allocate their time away from monotonous tasks—yet credit and finance teams spend 42 hours per week on manually processing credit applications,” says CEO Nauman Hafeez. “The NetNow platform was created to streamline the most time-intensive aspects of applying for credit, to prioritize what truly counts.”

The pre-seed funding will be used to accelerate AI product development, according to Hafeez, as credit management enters “a golden age of technology and transformation.”

Existing solutions are paper-and-process intensive, the CEO posits, leaving the industry ripe for disruption with automation and better data.

For example, building materials distributors like lumber yards, steel mills, and manufacturers need a better way to manage credit for new and existing contractors and construction projects.

“NetNow is uniquely positioned to be the first credit management platform that prioritizes the building materials industries like lumber, steel, concrete, and agriculture,” believes Matt Cohen of Ripple Ventures. “Their world-class team is dedicated to accelerating sales and credit approvals for industries that can benefit from this technology the most.”

The fintech’s digital automation lowers credit processing time, reduces debt, and identifies top credit accounts to increase sales, resulting in an average of 11x return on investment for customers, according to a statement from NetNow.

The firm also revealed that it has secured a grant from Intuit for earning its “Most Customer Obsessed Company” award.

Leave a Reply