A digital financial platform for Canadian businesses this week released an automated vendor payment functionality.

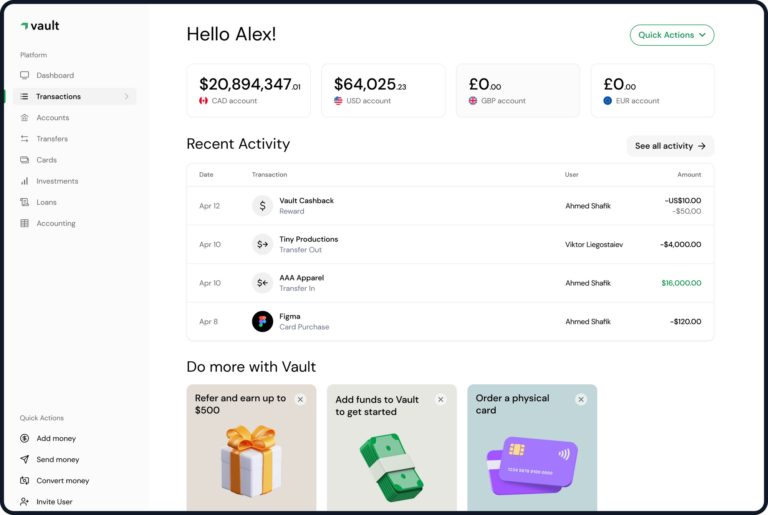

Toronto’s Vault says the new functionality is designed to increase payment accuracy with enhanced accounting software integrations and is set to “transform how businesses manage their payable processes [by] offering a true 2-way sync.”

The The Accounts Payable feature, which integrates with existing accounting softwares like Quickbooks or Xero, addresses a problem that company cofounder Ahmed Shafik was hearing from customers.

“We heard from our customers that they were spending multiple hours per week paying bills,” Shafik says. It was simply too much time for the task.

Businesses can now manage and pay hundreds of bills simultaneously, Shafik says, reducing the time spent processing payments.

“The Accounts Payable feature is designed to make financial operations more efficient, giving businesses the tools they need to scale,” the entrepreneur stated.

To further enhance financial control, Vault provides multi-level payment approval workflows, the company says, which ensures all payments comply with internal processes prior to funds being sent to different vendors.

Vault was founded in Toronto in 2021 by Shafik and Saud Aziz and launched in Canada last year.

“Aziz and I have parents who are small business owners; we experienced first-hand the antiquated banking services that constrained their ability to freely manage how they spend, move and manage their money, all while enduring excessive fees,” Shafik recalled in 2023. “We founded Vault to change this.”

Leave a Reply