Accounting is a common and necessary practice that has been transforming in recent years as emerging technologies rapidly evolve to impact the field.

“The conversation started off about bookkeeping and became ‘how can we boost your tech stack to streamline operations’,” recalls Canadian accountant Jules Hawkins.

Hawkins’ 2022 conversation was with Vincent George, director of the Windsor International Film Festival.

Battered by COVID, it was time for the annual Canadian festival to adapt and modernize.

“We went from shoeboxes and Excel sheets to this powerful new system,” says Vincent.

This is one example cited in the recent “State of the Industry: Leveraging the App Advantage” report, commissioned by New Zealand fintech Xero, which offers an interesting analysis of how Canadian accounting practices are embracing technology, particularly apps, to serve their small business clients better.

By integrating apps, practices can operate more efficiently, save time, and provide better service to their business clients, according to Xero. This can strengthen relationships and open new revenue streams.

The report, based on a survey of hundreds of accountants and bookkeepers, highlights how technology is reshaping the accounting landscape, with cloud technology and integrated app ecosystems playing a pivotal role.

For example, the integration of apps is beneficial for streamlining bookkeeping tasks, which are inherently data-intensive and repetitive. The survey reveals that 91% of practices use apps for their small business client work, with adoption rates high among both larger practices (98%) and sole practitioners (87%).

While bookkeeping remains the most common service offered, the report also identifies opportunities for diversification.

Released during Xerocon Nashville this month, the report introduces the concept of app advisory as a potential billable service. Services like software advisory and implementation are offered by only 55% of practices, presenting untapped potential for growth.

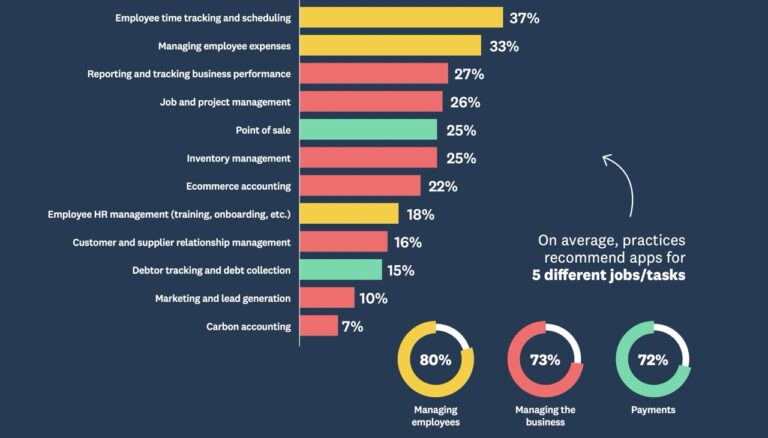

Moreover, practices that leverage different apps for multiple services are more likely to experience revenue growth, Xero’s data suggests, with 66% of such practices reporting increased revenue in the past year. A stack size of five apps was the average recommendation.

“The case for apps and app advisory is clear,” the report concludes. “With a broad range of benefits … practices of every shape and size have a lot to gain.”

As the accounting profession becomes increasingly intertwined with technology, the demand for expert advice on app usage will likely grow, Xero predicts. Practices that position themselves as knowledgeable advisors in this area are poised to capitalize on this trend, driving client satisfaction and practice growth.

Leave a Reply