A business banking platform based in Canada has raised a substantial Series B round.

Toronto’s Relay Financial this week announced the close of a US$32 million round led by Bain Capital Ventures.

With total funding now north of US$51 million (Series A financing was secured in 2021), Relay is looking to accelerate product development across spend management, smart credit, and a financial API marketplace.

It’s all a part of the fintech’s overarching goal to deliver AI-powered predictive cash flow analytics to small businesses—thus solving a major pain point for many entrepreneurs.

“68% of U.S. small business owners have cash flow problems,” says Yoseph West, cofounder and chief executive of Relay. “They worry about making payroll and mission-critical bills but lack the tools to truly address these existential threats.”

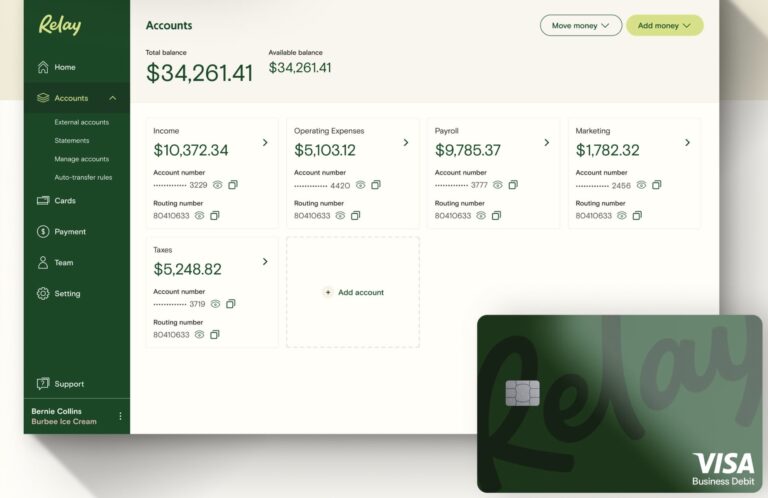

SMBs want to see what is earmarked for different expenses and understand cash positions at a glance—which is what Relay delivers, according to West.

“Relay gives them cash flow clarity and control—what SMBs need to sustainably fuel everyday operations—by pairing financial services with software and making banking work harder for them,” the CEO says.

The funding—which included previous Relay investors BTV, Garage, and Tapestry, as well as new participation from Industry Ventures—follows consecutive years of marked growth; the company claims revenues rose by roughly 300% in 2022 and by another 600% in 2023.

“Relay’s been on an incredible trajectory, even as others in the industry have had to pivot and find new footing,” stated Kevin Zhang, Partner at Bain Capital Ventures. ”We were eager to get behind Relay again as the company enters its next stage of growth and doubles down on the unique needs of the SMB market.”

On average, business owners log into Relay 13 times per month, and 40% of customers who use Relay for their primary banking log in daily, according to the company, which recently launched a credit card solution.

Relay was founded in Toronto in 2018.

Leave a Reply