Since the storied Shopify started up back in 2006, growth has been the name of the game.

Although there have been hiccups—even Shopify was not immune to Pandemic-era turbulence—the Ottawa-born company is nothing short of a phenomenally successful tech story: In less than two decades, Shopify rose to become not just Canada’s biggest fintech, but among the largest companies in the nation across all sectors.

Indeed, in 2024, Shopify’s market capitalization rival’s Canada’s biggest and oldest firms, from incumbent financial titans Royal Bank and Toronto Dominion Bank to the venerable Canadian National Railway and Canadian Pacific Railway.

So Shopify should be happy. But it’s not. And here’s why.

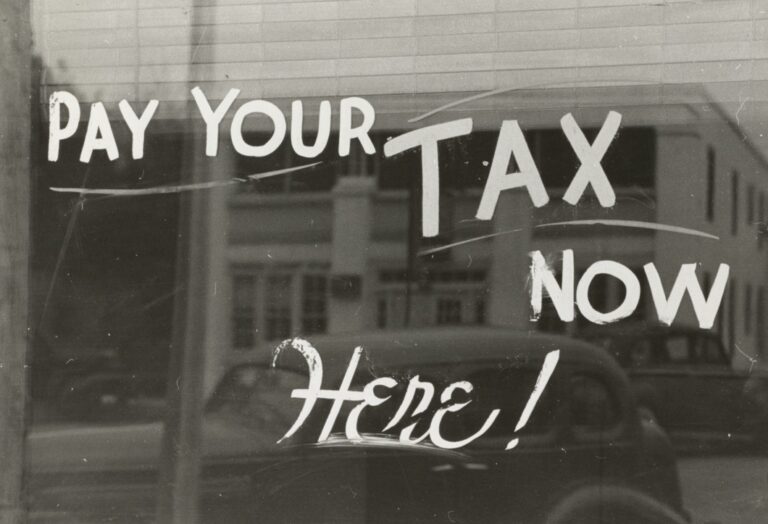

Canada’s federal government recently dropped its new budget and there’s something in particular about it that many entrepreneurs across the nation have expressed discontent with.

Specifically, the budget significantly raises the tax rate on capital gains for individuals who have more than $250,000 capital gains in a year, from half to two-thirds.

While this may sound to some like a relatively harmless tax raise on the ultra-wealthy, the budget change could have unintended consequences.

In particular, the tax rate deals a blow to entrepreneurs in Canada, experts point out.

Shopify CEO Tobi Lutke was unimpressed with the news, quoting a friend who responded to the budget by stating that Canada’s government is “determined to . . . leave no stone unturned in deterring [innovation].”

Harley Finkelstein, Shopify’s President, agreed, posting his opinions on the matter on X.

“We need to be doing everything we can to turn Canada into the best place for entrepreneurs to build,” Finkelstein wrote. “What’s proposed in the federal budget will do the complete opposite.”

Innovators and entrepreneurs will suffer and their success will be penalized, according to Finkelstein.

“This is not a wealth tax,” he said. “It’s a tax on innovation and risk taking.”

The Shopify veteran fears it may worsen Canada’s longstanding problem of “brain drain” to the U.S., where opportunities appear more ripe.

“Our policy failures are America’s gains,” Finkelstein warns. “At a time when our country is facing critically low productivity and business investment, our political leaders are failing our country’s entrepreneurs.”

Shopify is hardly the only complaining party. Entrepreneurs coast-to-coast have spoken out this week against the budget change.

For example, The Council of Canadian Innovators opposes the tax raise, with president Benjamin Bergen believing that the hike could “do irreparable harm to the Canadian innovation economy.”

Bergen asserts politicians may be taking these steps “without fully understanding the immense damage they risked doing to fledgling Canadian technology companies.”

Canada is ignoring the obvious way forward, he says.

“The fact of the matter is that the best way to boost revenue for the government is to drive economic growth and productivity gains, and the best possible way to do that is by championing the success of Canada’s homegrown innovators,” Bergen stated.

Leave a Reply