The media environment in 2024 continues to present more complexity for marketers looking to capture audiences, drive traffic, and build awareness and brand presence. These intersecting objectives need to be tailored to the marketer’s audience and narrowed to reflect unique initiatives within the brand’s scope.

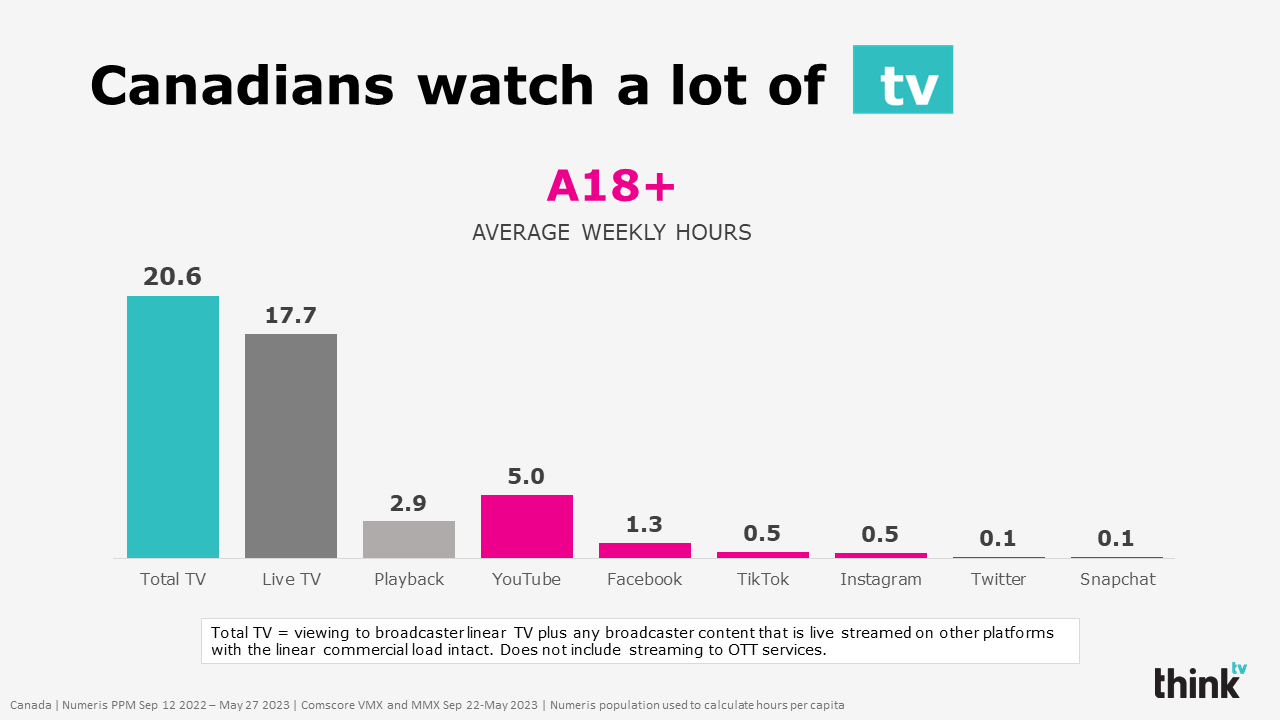

As platform-based companies with highly skilled digital marketing teams, fintechs typically scale new user acquisition through advanced digital advertising strategies. But to capture the attention of potential customers and cut through the competitive marketplace requires integrated campaigns that boost brand awareness, both on and offline. Linear (offline) television still plays an important role in the marketing mix, with the effectiveness of TV ads shown to grow the fastest and last the longest.

From Crypto.com to Wealthsimple, when it comes to reaching their target audience and building trust with their customers, here’s why forward-thinking brands consider linear (offline) TV as part of their carefully selected ad strategy.

Broad Reach

Despite the growth in streaming, linear TV is still the most powerful advertising medium, with the average campaign delivering 348 million impressions and 83 per cent weekly reach, according to ThinkTV. This represents a vast opportunity to extend your audience far beyond that of targeted digital efforts. Often considered the “lean back” as opposed to “lean forward” (digital) audience, the broader TV landscape allows fintechs to engage a large audience at low CPMs and refine media plans to optimize response.

Trust and Credibility

Fintechs – startups in particular – need to build credibility before customers will allow them to handle their money. Increased brand awareness can help build that trust, and television as a medium remains an authoritative and trustworthy source of information among mass audiences. Thoughtfully crafted TV commercials aired on established channels build awareness and boost critical trust with fintech brands, while leveraging special events and in-program sponsorship opportunities can also add value.

Brand Building

A strategically produced series of TV spots can create an emotional and impactful connection with viewers to drive brand identity and retention. Online investment firm Questrade became a well-established brand by leveraging TV spots as part of its ad strategy. In 2017, they kicked off their “Ask Tough Questions” campaign with TV commercials that empowered consumers to get informed about their money. According to Strategy, Questrade’s business more than doubled its monthly growth, increasing to more than $5 billion in assets.

Storytelling Opportunities

Numerous studies have shown that social media has shrunk people’s attention spans in measurable ways, meaning digital spots often max out at 15 seconds. However, TV ad campaigns not only allow for longer-form storytelling compared to many other mediums, but they also get the most attention compared to social media and online video according to a 2022 YouGov brand index tracking survey. Fintech brands can use TV to educate viewers about their products and recent offers, showcasing success stories or explaining more complex financial concepts in a way that engages and resonates with the audience.

Targeting Specific Audiences

Fintech brands can leverage data to ensure their TV ads reach specific demographics. Using targeted, regional ad buys can help with brand building, maximizing awareness efforts among key audiences while keeping budgets contained. Keep in mind that fintech services aimed at older adults, for whom television is still a popular medium, represent a lucrative market. At least for the near future, their buying power significantly outweighs that of Millennials across many categories. In addition, as a linear TV plan roles out, there are further opportunities to run connected TV creative at the same time to gain momentum and complement the linear campaign with specifically targeted buys.

Event-Based Advertising

Fintech brands can leverage linear TV advertising during specific events, such as financial news program interviews or opinion pieces align their messaging with relevant contexts. This can help reach audiences who are specifically interested in financial products and solutions. As the most popular event in the US, the NFL’s Superbowl draws millions of viewers, many of whom are more interested in watching the ads. Payroll and payments platform Papaya Global launched its NFL advertising spot this year, following the success of other B2B FinTech brand ads.

Consumer Behavior Integration

While digital marketing efforts form the base of most fintech brand launches and initial success, TV can be used to complement digital marketing efforts across social to drive brand awareness and ROI with targeted calls to action. Traditional TV audiences are still strong, and integrating advertising into a medium that they are familiar with can tap into common consumer behaviors. For example, showing ads during the news or a business program will potentially reach individuals who may not be as active online or on digital platforms.

As the fintech space becomes increasingly competitive, TV advertising will help brands stand out from the crowd allowing for creative and memorable messaging that can leave a lasting impression on potential customers, increase a brand’s share of voice among its competitors, and have a direct impact on the bottom line.

When navigating the linear TV advertising landscape it’s important to work with an experienced and agile media, creative and digital agency with expertise in dealing with a wide array of TV partners. Look for experienced digital teams can share data and access ROI-driven digital opportunities related to linear TV schedules in connected, OHH and related digital channels.

Geoff Crain, Senior Director of Sales & Marketing with Kingstar Media, has over 12 years of experience in planning, buying and optimizing offline and online media for some of the world’s top brands.

Leave a Reply