A Canadian company merging open banking and instant payments through an all-in-one gateway has raised a round of capital from a US investor as it eyes expansion south of the border.

Montreal-based Zūm Rails today announced the closing of a $10.5 million Series A round led by Arthur Ventures, a growth equity firm headquartered in Minneapolis that specializes in B2B software.

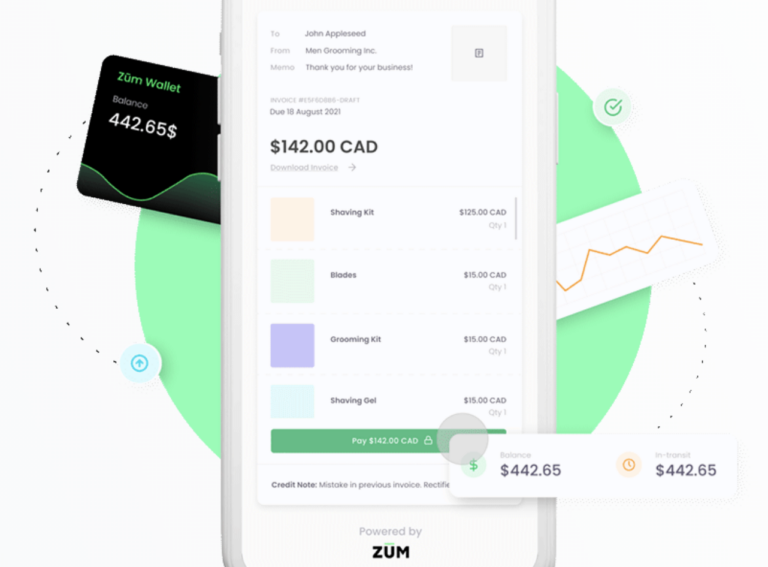

The financial technology firm integrates open banking and instant payments into a single gateway that powers the entire transaction journey—including everything from verifying a customer’s identity to facilitating payments via the method of the customer’s choosing.

This “omni-rail” approach to payments includes both traditional credit, debit and electronic funds transfer options, as well as real-time options through partners such as Visa, Mastercard, and Interac network, according to Marc Milewski, a cofounder of Zūm.

“Companies that want to move money instantly need to adjust for risk, and open banking is the greatest gift to payments in this regard,” chief executive officer Milewski explains. “We’ve brought open banking and instant payments together in an omni-rail solution that enables companies to check off all of their payments needs from a single gateway.”

So far, the bootstrapped startup has managed to turn a profit, but still welcomes the influx of capital from Arthur.

“With Arthur Ventures’ investment, we’re positioned for further expansion of our solution through the addition of Banking-as-a-Service and other new capabilities,” Milewski said.

Compared to other markets around the world, North America has been slow to standardize practices around open banking and instant payments, he says. Options for businesses to offer open bank experiences to consumers are fragmented.

Zūm Rails’ growth is “validation of its ability to solve this problem,” according to Jake Olson, vice president of Arthur Ventures.

“Payments are the lifeblood of every business,” he says, “but too often, keeping up with the ever-evolving array of services needed to process payments quickly, efficiently and securely stands in the way of success.”

Olson posits that Zūm has “already transformed the Canadian payments landscape.” Moving forward, the fintech is “well-positioned to increase this growth with the investments it’s making in its product and scaling its presence across all of North America.”

Battling on “the front lines” of payment technology innovation in Canada, Zūm cofounder Miles Schwartz says the fintech is now preparing to “double down on our expansion in the U.S” following his company’s fundraising.

Zūm was founded in Montreal in 2019 and was named among Canada’s most innovate startups in 2022.

The fintech’s platform processes more than $1 billion in payments each month for major companies including Questrade, Coinsquare, and Desjardins.

Leave a Reply