The results of a recent study conducted by a Canadian financial technology firm suggests that strategic payment optimization can significantly enhance the revenue of e-commerce businesses.

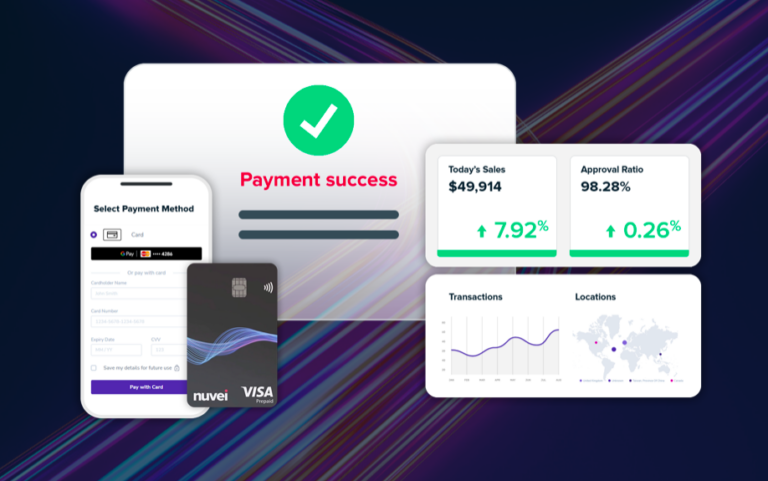

The white paper from Montreal’s Nuvei, titled “Accelerating Revenue Growth,” lays out the claim that incremental payment optimization can drive up to 30% revenue gains.

“Payment optimization is key to helping our customers accelerate their revenue,” affirms Philip Fayer, chief executive of Nuvei. “Our latest research highlights the reasons it should be at the core of any payment strategy.”

Surveying over 300 payment leaders across the world’s biggest brands, Nuvei’s research offers a wealth of insights, practical strategies, and case studies for businesses seeking to harness the full power of their payments.

For example, at least 30% of authenticated transactions for e-commerce merchants are declined, and up to 40% of those declines result in a fully lost transaction. There’s a lot of potential in those numbers to optimize.

“By understanding the nuances of payments optimization, we intelligently apply functionality and features at every stage; pre-transaction, during transaction routing, and post-transaction to achieve the highest approval rates possible,” Fayer says.

Connecting businesses to customers across 200 markets, 150 currencies, and more than 600 alternative payment methods, Nuvei provides technology and insights for partners to succeed locally and globally with one integration.

The fintech has announced several recent collaborations, including Cash Pay, Plaid, Microsoft, and Adobe.

“At Nuvei, we’re not just enhancing payment processing,” says Fayer. “We’re revolutionizing it.”

Founded by Fayer as Pivotal Payments in 2003, Nuvei today trades on the Toronto Stock Exchange as NVEI.

Leave a Reply