Float is flying into 2024 with fervour.

The financial technology startup was established by Griffin Keglevich and Ruslan Nikolaev, two graduates of Waterloo’s computer science and business programs, in 2019.

And since raising capital in 2021, Float has been growing rapidly.

Last year, for example, the Toronto-based fintech quadrupled revenue.

This week, Float unveiled the backing of a $50 million credit facility in partnership with Silicon Valley Bank, a division of First Citizens Bank.

The company thus has access to significant capital to expand its Charge Card program, which saw tremendous payment volume growth in 2023, according to chief executive Rob Khazzam.

As inflation remains stubborn, Canadian businesses are getting squeezed by banks, the CEO says. Float’s platform empowers companies to scale by simplifying financial solutions.

“At a time when other financial institutions are pulling back on serving Canadian SMBs, our partnership with SVB is a powerful reflection of the strength of Float’s vision, strategic direction and hyper-growth in 2023,” he stated.

Brian Foley, Market Manager for Silicon Valley Bank’s Warehouse and Fintech group, believes that Float is “challenging the status quo when it comes to providing payment solutions for Canadian companies and teams.”

“Our strong partnership demonstrates SVB’s commitment in helping fintech companies succeed and scale,” he continued. “We’re thrilled to be a part of Float’s growth and bolster its expansion across the country.”

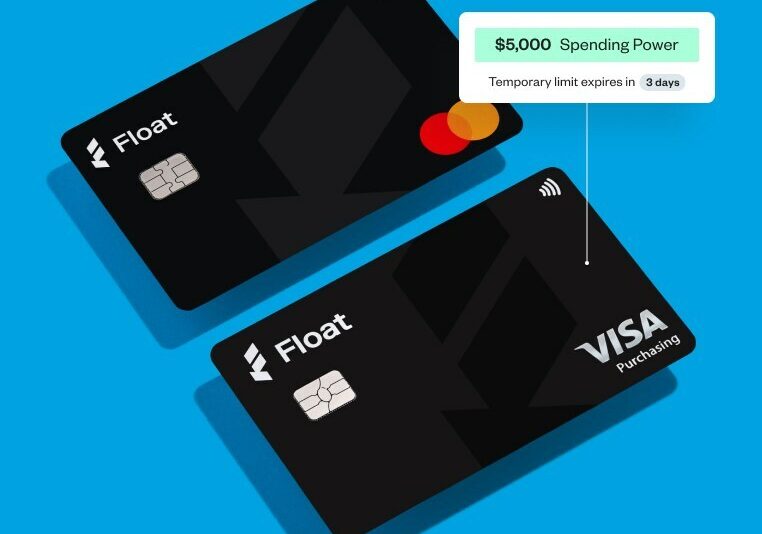

Much of the startup’s success lies in its rethinking of corporate spending management. Float’s solution is a smart corporate card linked to spend-management software that automates manual processes involved in managing card-linked spending, such as issuing cards for employees, tracking down receipts, and reconciling expenses at the end of the month.

The fintech’s automations and enhancements “save thousands of hours in manual accounting tasks.” And in addition to saving time, Float customers can see company spending and analyze trends with financial data visualizations.

However, not every product launch from Float has been successful.

In 2022, the startup launched Retained Learnings, a monthly digital magazine for forward-thinking Canadian finance leaders, and a sister property to their Retained Learnings podcast which is hosted by CEO Khazzam.

“At Float we like to make big bets,” the company announced in 2022. “And one big bet we’ve made is to launch our own magazine.”

The magazine lasted just five issues, last updated in December 2022. The podcast carried on, but also seems to have fizzled out; the last episode was in November.

Still, the fintech is finding major success with its core business, and that’s where the firm’s target remains fixed. In 2024, Float will “continue to expand its footprint with new payment and software solutions purpose-built for Canadian companies,” according to a statement from the company.

Leave a Reply