Investment in Canadian financial technology firms slowed significantly through 2023, finds KPMG’s latest global Pulse of Fintech report, which observed the number of deals drop last year by more than half and values fall nearly 30 per cent.

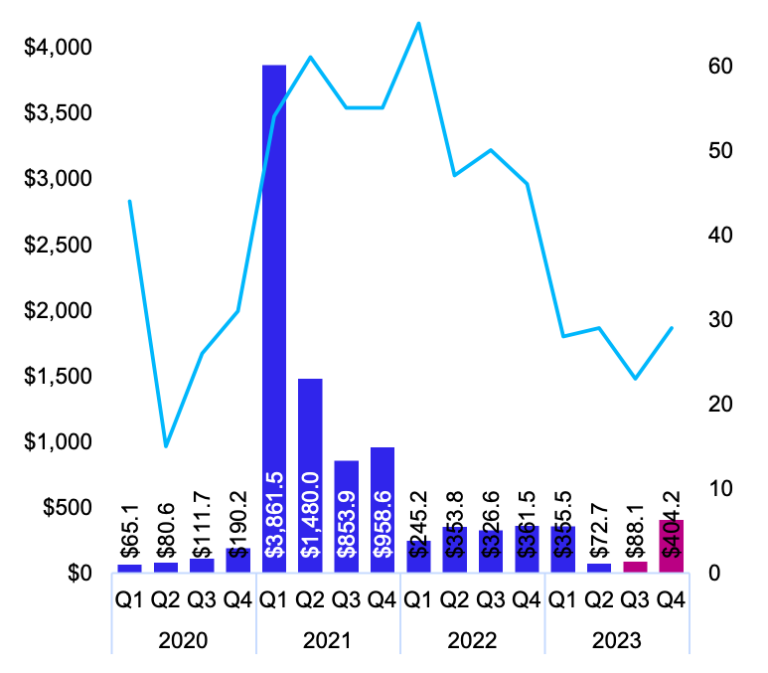

Investment in Canadian fintechs dropped to US$920 million across 109 total deals in 2023, down from US$1.29 billion invested across 208 deals in 2022, according to KPMG’s Pulse of Fintech H2’23, which leverages data compiled by PitchBook.

One silver lining is that, worldwide, Canada fared okay: globally, deals fell 65 per cent and values plummeted 73 per cent.

Still, there are reasons for concern—it is the second consecutive year in which investment dropped following a record high US$7.15 billion in 2021 across 225 deals.

The next several months may remain slow for fintech investments, according to Georges Pigeon, a partner in KPMG in Canada’s deal advisory practice, which could “make it difficult for fintechs that require funding in the near term and force them to rethink how to position themselves to investors.”

Pigeon expects 2024 to be a pivotal year for Canadian fintechs as larger incumbents accelerate innovation and growth while less mature fintechs face financing shortfalls as they run low on capital raised in prior years.

“Fintechs that can demonstrate they are sustainable and valuable businesses will have an edge over those that emphasize themselves as quick technology solutions providers,” he believes.

Pigeon anticipates investment activity to remain sensitive to interest rates and thus activity should pick up once the Bank of Canada starts issuing rate cuts.

And if the federal government is able to finally introduce open banking legislation in its upcoming budget, that could further boost investor confidence in the Canadian sector, he says.

“Open banking could be a catalyst for fintech investors,” Pigeon posits, admitting “the impact won’t be immediate.”

“It’ll take time for Canadians to adopt and embrace open banking,” he says, “and that will influence how investors approach fintech investment opportunities in Canada.”

Unfortunately, Canada is still stalling on open banking.

Regardless, the influences aren’t just local. A “confluence of factors”—including market cycles, economic slowdown, market volatility, higher capital costs, and geopolitical tensions—have spurred subdued investment worldwide, according to KPMG, and Canada is no exception.

“The investment landscape for Canadian fintechs faced numerous challenges in 2023, including elevated capital costs, market volatility and a stalling economy,” stated Geoff Rush, KPMG in Canada’s National Industry Leader for Financial Services.

Even so, Rush envisions a turnaround on the horizon.

“It appears the bottom has been reached and some of those headwinds will start to become tailwinds as economic pressures eventually begin to ease,” he continued. “Factors point to growth for Canada’s fintech ecosystem.”

Some of that fintech growth potential hails from the web3 world, where an increasingly legitimate Bitcoin (there are ETFs now!) watches blockchain technology garner sustained interest from investors.

For the second year in a row, there were more investments in the cryptocurrency and blockchain space than any other vertical—with an impressive 31 deals in total—data shows.

Software-as-a-service fintechs, in second place, drew 24 investments while artificial intelligence and machine learning startups garnered a combined 15 investments.

“Notable investment in blockchain infrastructure suggests that investors could be thinking ahead to the future, where a central bank digital currency or ‘digital dollar’ might one day become a reality in Canada,” says Edith Hitt, a partner in KPMG’s advisory practice who specializes in banking technology.

“If that happens,” she said, “blockchain could potentially be the infrastructure that’s used to underpin that system, and that could be another growth catalyst for Canada’s fintech ecosystem.”

Leave a Reply